A solid DeFi portfolio allocation isn't just about chasing the highest yields. It’s about strategically spreading your capital across different protocols and assets in a way that lines up with your financial goals and, just as importantly, your stomach for risk. Think of it as a blueprint for sustainable growth and capital preservation in a market that's anything but predictable.

Establishing Your Personal DeFi Investment Thesis

Jumping into DeFi without a plan is like sailing without a map—you might stumble upon treasure, but you're far more likely to get caught in a storm. Before you put a single dollar to work, you need a personal investment thesis.

This isn't some complex, formal document. It's a straightforward statement about what you want to achieve and the risks you're willing to take to get there. It’s the "why" behind every transaction you make, ensuring your decisions are deliberate, not just reactions to market noise.

Your thesis is your north star. It guides your DeFi portfolio through the crazy market cycles and forces you to be honest with yourself. Are you aiming for a steady 5-8% APY on stablecoins to keep your capital safe? Or are you hunting for those juicy double-digit returns that naturally come with much higher risk? There’s no right answer, only the one that fits your situation.

Defining Your Financial Goals and Timeline

First things first, you need to get crystal clear on your objectives. Vague goals like "make money" won't cut it. You need to be specific.

Capital Preservation: Is your main goal to protect your principal while earning a yield that beats inflation? This is a common approach for those managing a treasury or simply looking for a low-risk alternative to a traditional savings account.

Moderate Growth: Are you comfortable taking on some smart contract risk to get better returns? Maybe you're aiming for steady portfolio growth over a few years.

Aggressive Yield Generation: Is your objective to max out returns by diving into newer protocols, complex liquidity pools, and more experimental strategies? This means you have a high tolerance for potential losses.

Your timeline is just as crucial. Are you investing for the next six months or the next six years? A longer time horizon usually means you can afford to take on more risk, since you have more time to recover from any bumps in the road. If you need your cash to be accessible in the short term, you'll want to stick to a more conservative strategy focused on stable, liquid assets.

Honestly Assessing Your Risk Tolerance

DeFi is packed with opportunity, but it's also loaded with risk—from smart contract exploits to stablecoin de-pegs. You have to be brutally honest with yourself here.

How would you really feel if a protocol you were in got hacked and your position dropped 50% overnight? Your gut reaction to that scenario tells you a lot about your true risk tolerance.

A well-defined investment thesis is your best defense against emotional decision-making. When the market is in a panic, your thesis reminds you of your long-term goals, preventing you from selling at the bottom or chasing unsustainable yields at the top.

The DeFi market is maturing, with some projections showing its value could hit USD 78.49 billion by 2030. While trading and investing still make up over 41% of revenue, we're seeing growing interest from institutions, especially for things like cross-border treasury management. This trend alone suggests that any smart DeFi strategy should probably include a slice dedicated to stablecoin strategies for stability and efficiency. If you want to dig into the numbers, you can explore the full DeFi market report.

Before we dig into building out some sample allocations, it helps to see how these different elements come together. Let's break down a few common investor profiles.

DeFi Investor Profile Characteristics

This table outlines the typical goals, risk levels, and strategies for different types of DeFi investors. See which one sounds most like you.

Profile | Primary Goal | Risk Tolerance | Typical Allocation Focus |

|---|---|---|---|

Conservative | Capital preservation, beating inflation | Low | Over-collateralized lending, blue-chip protocols, audited stables |

Moderate | Steady growth, balanced returns | Medium | Mix of lending, established LPs, some newer protocols |

Aggressive | Maximizing yield, high growth | High | Experimental strategies, new LPs, yield derivatives, points farming |

Treasury | Liquidity, capital efficiency, security | Very Low | Highly-audited, battle-tested lending protocols, minimal exposure |

Finding your fit in this table is a great starting point. A strong thesis also means staying informed on where the market might be headed. For different perspectives, it's always useful to read up on some honest thoughts on what comes next for Bitcoin and crypto. By combining your personal goals with a clear-eyed view of the market, you can build a resilient allocation strategy that’s truly your own.

Structuring Your Portfolio with Risk Buckets

Jumping into DeFi and just chasing the highest APY is a recipe for disaster. I've seen it happen too many times. A smarter approach is to think of your portfolio like a building: you need a rock-solid foundation, a sturdy core, and maybe a penthouse level for taking some bigger swings. This is exactly what the risk bucketing system helps you create.

It's a straightforward but incredibly effective way to slice up your capital based on risk. By creating these separate "buckets," you can chase growth without jeopardizing your entire stack. It's about moving from being a reactive degen to a strategic architect of your own DeFi wealth.

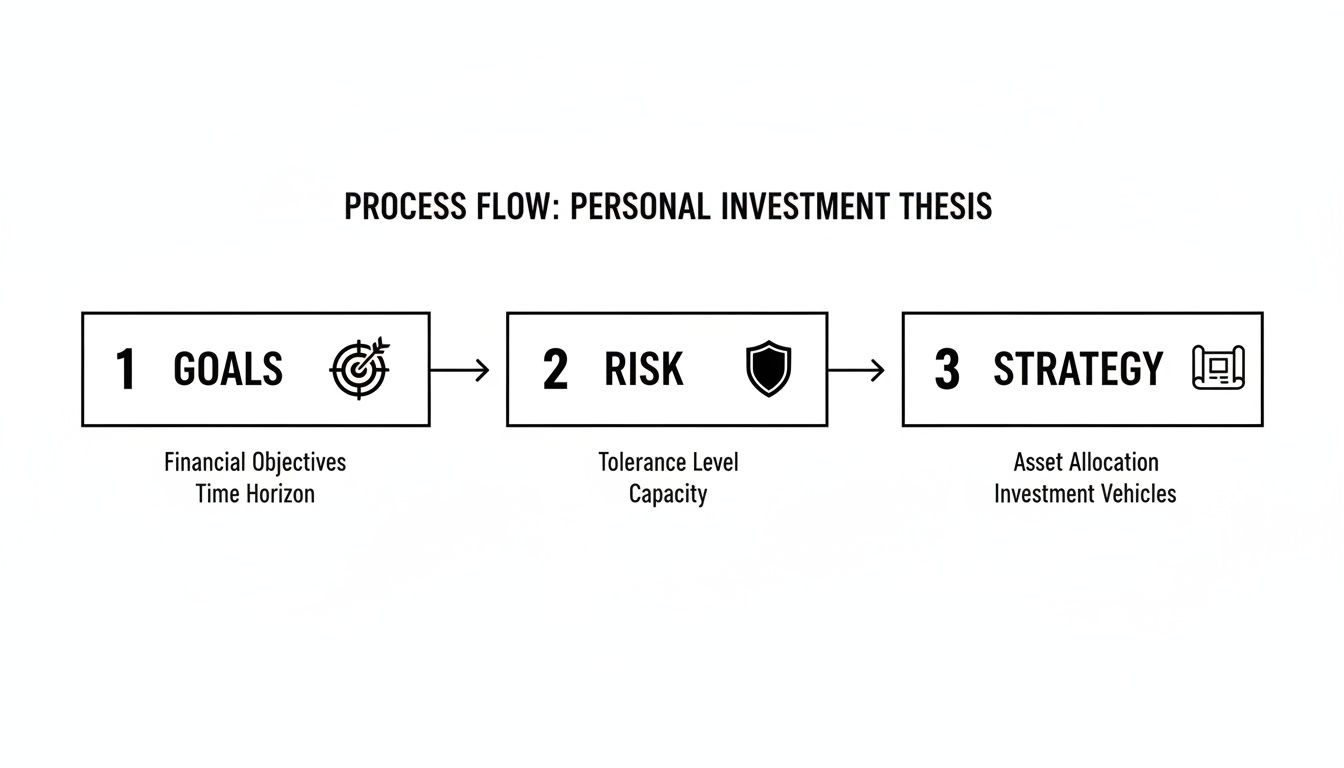

Your personal investment thesis—that sweet spot where your goals, risk tolerance, and strategy meet—is the blueprint for this entire process.

This diagram nails it: a solid strategy always starts with knowing what you want and how much risk you can stomach. Now, let's build the buckets that bring that strategy to life.

The Core Stability Bucket: Your Financial Bedrock

This is the foundation. The absolute non-negotiable part of your portfolio. The goal here is simple: capital preservation. We're not trying to hit home runs; we're aiming for steady, predictable yield from the safest, most battle-tested corners of DeFi.

Your Core Stability bucket is where you park capital in assets and protocols with the lowest perceived risk. Think of it as your on-chain, high-yield savings account.

Assets: Stick to the most reliable, over-collateralized stablecoins like USDC and DAI. They have a long, proven history of holding their peg.

Protocols: We're talking about the blue-chips, the household names of DeFi. Platforms like Aave and Compound have managed billions through insane market volatility and have been audited to death.

Your Core Stability bucket is your anchor. When the market inevitably dumps, this is the cash that keeps you liquid and lets you sleep at night, so you aren't forced to sell other assets at a massive loss.

For a conservative investor, this bucket could be as much as 70-80% of their total DeFi allocation. Even for aggressive players, it should probably be around 40-50%. Never skimp on your foundation.

The Growth Engine Bucket: Calculated Risk for Higher Returns

Once your foundation is set, it's time to build the next level. This is your Growth Engine. Here, we dial up the risk just a notch in search of higher yields. It's designed to beat your core holdings but stops well short of pure speculation.

This bucket is for well-established protocols that are still innovating, especially in thriving Layer 2 (L2) ecosystems or proven liquidity pools.

Strategies: This could mean providing liquidity to stablecoin pairs on reputable exchanges like Curve or Uniswap V3. Or maybe you're exploring yield farms on established L2s like Arbitrum or Base.

Risk Factors: You’re now dealing with things like impermanent loss and protocols that, while solid, might not be as grizzled as the blue-chips in your core bucket.

This part of your portfolio needs a closer eye. You'll want to regularly check in on pool performance and the overall health of the protocols you're using.

The Experimental Alpha Bucket: Your Small Bet on the Future

And now for the fun part: the Experimental Alpha bucket. This is the smallest slice of your portfolio, reserved for high-risk, high-reward plays. This is capital you can genuinely afford to lose. The entire point is to catch asymmetrical upside from brand-new narratives and emerging projects.

Assets and Protocols: We could be talking about yield farming on a protocol that launched last week, grabbing new project tokens, or even diving into points farming for potential airdrops.

Position Sizing: This is critical. You have to be strict here. A good rule of thumb is to keep this bucket at no more than 1-5% of your total portfolio. No single position should ever be big enough to wreck you if it goes to zero.

Let's be clear: this bucket is speculative. Most of these bets won't pan out. But just one big win can have a massive positive impact on your overall returns. Success here comes down to doing your own research and truly understanding the risks you're taking. If you want to get deeper into this, check out our guide on the best practices for risk management in DeFi.

By spreading your capital across these three buckets, you create a portfolio that's both resilient and adaptable—ready to protect your core capital while still capturing the incredible opportunities DeFi has to offer.

Building Your Core Stablecoin Strategy

Your 'Core Stability' bucket is the bedrock of your DeFi portfolio. This isn't where you chase those high-risk, high-reward moonshots; this is where you build a foundation designed to preserve your capital while grinding out a reliable, low-volatility yield. Think of it as your portfolio's anchor—it provides liquidity, tamps down volatility, and keeps generating income even when the broader market is in chaos.

Stablecoins have become an absolute juggernaut in the crypto economy. You can see their importance in the raw numbers: they accounted for roughly 30% of all crypto volumes heading into 2025. With trading volumes exploding by 83% year-over-year to hit a massive $4 trillion between January and July, it's obvious they are the functional backbone of the market. This is exactly why a smart DeFi allocation dedicates a solid chunk—often 20-30%—to these assets for essential stability.

So, a solid strategy starts with picking the right tools for the job.

Picking Your Stablecoins

Let's get one thing straight: not all stablecoins are created equal. The ones you choose have a direct impact on your risk and stability. For this core bucket, we're only interested in assets with a long history of transparency, deep liquidity, and a proven ability to hold their peg when markets get rocky.

Fiat-Backed (like USDC, USDT): These are backed 1:1 by fiat currency and other cash-like assets held in audited bank accounts. They’re generally seen as the most straightforward and stable. Many prefer USDC for its reputation for transparency.

Crypto-Collateralized (like DAI): These are backed by a surplus of other crypto assets (like ETH) locked in smart contracts. They are more decentralized but carry a different kind of risk tied to the volatility of their underlying collateral.

For a core strategy, it's often wise to use a mix. You might put a larger allocation into a highly regulated option like USDC, then complement it with a smaller position in a decentralized stablecoin like DAI. This diversifies your risks away from a single point of failure, whether that's a custodian or a smart contract.

Core Yield-Generating Strategies

Once you have your stablecoins, it’s time to put them to work. The goal here is sustainable yield, not chasing the highest APY and exposing your foundation to unnecessary danger. Here are a couple of battle-tested approaches I’ve used time and again.

Blue-Chip Lending Protocols

This is the most common and direct way to earn yield on stables. Platforms like Aave and Compound are the grizzled veterans of DeFi. They've survived multiple market cycles, gone through countless security audits, and currently secure billions of dollars in assets.

It's a simple mechanic: you deposit your stablecoins into a lending pool, and borrowers pay interest to take out loans against their own collateral. You get a piece of that interest as yield. The rates fluctuate with supply and demand, but they're typically reliable.

My Pro Tip: Don't just look at the advertised APY. Dig a little deeper. Check the Total Value Locked (TVL) as a proxy for market trust, review their security audit history, and understand what collateral they accept. A protocol that only accepts high-quality collateral like ETH and BTC is much less risky than one accepting volatile, long-tail altcoins.

Stablecoin Liquidity Pools

Another great strategy is providing liquidity to stablecoin-focused pools on decentralized exchanges (DEXs) like Curve or Uniswap V3. These pools are designed specifically to facilitate swaps between different stablecoins, like from USDC to DAI. When you act as a liquidity provider (LP), you earn a slice of the trading fees from every swap.

Because all the assets in the pool are pegged to $1, the risk of impermanent loss is massively reduced compared to pools with volatile assets. This makes them a perfect fit for the 'Core Stability' bucket.

An Example Stablecoin Allocation

Let’s make this practical. Say you've earmarked $10,000 for your Core Stability bucket. A conservative setup might look something like this:

Strategy | Protocol | Asset | Amount | Rationale |

|---|---|---|---|---|

Lending | Aave | USDC | $5,000 | The safest, most battle-tested protocol with a highly regulated stablecoin. |

Lending | Compound | DAI | $2,500 | Diversifies protocol risk and uses a top-tier decentralized stablecoin. |

Liquidity Providing | Curve | USDC/DAI/USDT | $2,500 | Spreads risk across three major stables while earning trading fees. |

This simple allocation diversifies your capital across two different strategies (lending and liquidity) and three different, highly-reputable protocols. This way, no single point of failure can torpedo your entire core bucket. If you want to dive deeper into the numbers, check out our analysis of current stablecoin interest rates to see how various platforms stack up.

At the end of the day, your stablecoin strategy is your portfolio’s first line of defense. By sticking to high-quality assets and battle-tested protocols, you create a powerful engine for steady, reliable yield that can provide stability—and opportunity—no matter what the market throws at you.

Vetting Protocols and Diversifying Your Assets

Once you’ve got your risk buckets and core stablecoin strategy mapped out, it's time for the real work: picking the right protocols. This is where the rubber meets the road. I can't stress this enough—the protocol you choose matters just as much, if not more, than the asset itself. A juicy yield is completely worthless if the smart contract holding your funds gets exploited.

This is the point where you need to put on your detective hat and do some serious homework. Rushing this step is a classic rookie mistake, and in DeFi, it can lead to catastrophic losses.

A Practical Due Diligence Checklist

Before you even think about depositing a single dollar, you have to run every potential protocol through a rigorous vetting process. I personally use a mental checklist that covers everything from security and team reputation to the platform's economic design.

Here’s a quick rundown of what I always look for:

Security Audits: This one is non-negotiable. Look for multiple audits from reputable firms like Trail of Bits, OpenZeppelin, or Certik. More importantly, don't just check if an audit exists—actually read the report. Were there any critical vulnerabilities found? Did the team fix them properly?

Team and Track Record: Who’s actually building this thing? Are they public figures with a proven history of shipping secure products, or are they a team of anonymous devs? A public, experienced team adds a massive layer of accountability.

Total Value Locked (TVL): TVL isn’t the be-all and end-all, but a high and stable TVL (think $100 million+ for established protocols) is a strong social signal. It tells you the market trusts the platform with a significant amount of capital, meaning it's likely been battle-tested.

Community and Communication: Is there an active Discord or governance forum? A healthy, engaged community is usually a good sign. Pay attention to how the team communicates during times of stress or technical hiccups—it speaks volumes about their professionalism.

Key Insight: A security audit is just a snapshot in time, not a permanent get-out-of-jail-free card. I always look for protocols with multiple audits over time and an ongoing bug bounty program. It shows a continuous commitment to security, not just a one-time checkbox exercise.

Failing to properly assess these factors is an incredibly common pitfall. To build a stronger foundation for your analysis, you might want to dive deeper into what goes into a comprehensive smart contract security audit to better understand what to look for.

The Art of True Diversification

In DeFi, diversification is about so much more than just holding a few different tokens. Real, lasting resilience comes from spreading your risk across multiple, uncorrelated vectors. A truly diversified DeFi portfolio allocation ensures that a single point of failure—whether it’s a bug, a hack, or a team going rogue—doesn't wipe you out.

This means you need to think about diversification on several different levels.

Diversifying Across Blockchains and Protocols

Don’t put all your eggs in one blockchain basket. If all your assets are on Ethereum, you're not just exposed to its high gas fees but also any network-level risks that might pop up. A much smarter approach is to spread your allocation across a few different chains.

Ethereum: The home for your most secure, core positions in battle-tested protocols like Aave.

Layer 2s (Arbitrum, Base): Perfect for your growth strategies where lower transaction fees are essential to stay profitable.

Other L1s (Solana, Avalanche): Great for more experimental plays or to tap into ecosystems with entirely different strengths and communities.

The same logic applies to protocol types. Don't just stick to lending. A balanced mix could include lending protocols, decentralized exchanges (DEXs), and liquid staking platforms.

Diversifying Teams and Risk Types

Here’s a strategy that often gets overlooked: diversifying across different development teams. Even the absolute best teams can make mistakes. By spreading your capital across protocols built by different reputable teams, you shrink your exposure to any single team's potential blind spots or security lapses.

This also applies to the types of risk you're taking on. Your portfolio should have exposure to different kinds of DeFi risk:

Smart Contract Risk: The classic risk of a bug lurking in a protocol's code.

Market Risk: The risk that the price of your underlying assets tanks.

Centralization Risk: The risk tied to protocols that still have admin keys or rely on centralized oracles for price data.

By intentionally spreading your capital across these different layers, you create a portfolio that's far more robust and capable of weathering the inevitable storms that hit the DeFi market. This proactive approach to vetting and diversification is what separates the sustainable investors from those who get washed out.

Keeping Your Portfolio on Track: Monitoring and Rebalancing

So you've built your perfect DeFi allocation. Great! But the work doesn't stop there. Your portfolio isn't some "set it and forget it" machine; it's a living, breathing thing that needs regular check-ups to make sure it's still doing what you designed it to do.

Without a solid process for monitoring and rebalancing, even the most carefully planned strategy will eventually drift. This is how you protect yourself from making emotional, market-driven mistakes. When that token in your "Growth Engine" bucket suddenly doubles, the temptation to just let it ride is huge. But that's exactly how a balanced portfolio quietly morphs into a concentrated, high-risk bet you never intended to make.

A rebalancing plan forces you to be disciplined—to take profits when things are hot and reallocate back to your original targets. It’s the single best way to maintain your intended risk profile over the long haul.

Setting Your Rebalancing Triggers

The trick is to decide beforehand what will trigger a rebalance. This takes the emotion and guesswork out of the equation when markets are going crazy. A core part of managing any portfolio is understanding What is portfolio rebalancing?, and the principles apply just as much in DeFi as they do in TradFi.

I've found two methods work particularly well for DeFi allocations:

Time-Based Rebalancing: This is the simplest way to go. You just commit to reviewing and tweaking your portfolio on a regular schedule, like quarterly or semi-annually. It's frequent enough to catch major drift but not so often that you're just burning gas fees for no reason.

Deviation-Based Rebalancing: This approach is more dynamic and reacts to market moves. You set a tolerance band—say, 15%—for each of your risk buckets. If your "Core Stability" bucket is supposed to be 50% but drops below 42.5%, that’s a trigger. Same if your "Experimental Alpha" bucket grows from its 5% target to over 5.75%.

Honestly, a hybrid model is often best. Do your scheduled quarterly review, but also keep an eye out for any big deviations that might happen between those check-ins.

What to Actually Keep an Eye On

Effective monitoring is about more than just checking the dollar value of your wallet. A juicy APY can easily hide some ugly truths about the underlying protocol. You have to look deeper.

Here are the vital signs I always track for any position I hold:

Protocol Health: Is the Total Value Locked (TVL) holding steady or, even better, growing? If you see a sharp, sustained drop in TVL, that's a huge red flag. It means other smart people are pulling their money out, and you should probably figure out why.

Yield Sustainability: Where is that yield really coming from? Is it generated by real usage and trading fees? Or is it just inflationary token rewards that are destined to get dumped into oblivion? Sustainable yield is the mark of a healthy, long-term protocol.

Impermanent Loss (IL): If you're providing liquidity, IL is a silent portfolio killer. Use a dashboard or tracking tool to see how your LP position is doing compared to just holding the two assets. If IL is consistently eating away at your fee earnings, it might be time to pull the plug on that position.

Don't get mesmerized by a high APY. A 50% APY means nothing if the protocol gets hacked or the reward token crashes 90%. Always, always focus on the health of the system first and the yield second. This is the mental shift that separates long-term DeFi investors from the short-term speculators who eventually get wiped out.

By combining unemotional triggers with a sharp focus on these fundamental health metrics, you can keep your DeFi portfolio allocation strong and aligned with your goals. It's this disciplined, ongoing process that protects your capital from both wild market swings and protocol-specific blow-ups.

Common Questions About DeFi Portfolio Allocation

Putting a strategy into practice always brings up a ton of questions. It's one thing to sketch out a DeFi portfolio on paper, but it's a completely different ballgame to actually manage it through wild market swings and constant protocol updates.

Let's walk through some of the most common questions that pop up once you start putting real capital to work. Getting these sorted out ahead of time will give you the confidence to stick to your plan instead of making knee-jerk, emotional decisions when things get choppy.

How Often Should I Rebalance My DeFi Portfolio?

There's no single magic number here, but the best approach is almost always a disciplined one.

If you rebalance too often, you can get killed by gas fees and create a mess of taxable events that just chip away at your returns. On the flip side, never rebalancing means your carefully planned allocation will eventually drift into a much riskier position than you signed up for.

Most people find a good rhythm with one of these two approaches:

Time-Based: This is the simplest way to do it. You just schedule a portfolio review on a fixed timeline, say quarterly. This is usually frequent enough to catch any major drift without having you glued to your screen every day.

Threshold-Based: With this method, you only rebalance when one of your buckets strays from its target by a set amount, like 10-20%. So, if your Core Stability bucket was set to 50% and it grows to 60% of your portfolio, that’s your trigger to take some profits and reallocate.

Honestly, a hybrid approach often works best. Do a scheduled quarterly check-in, but also set up an alert in case one of your buckets has a massive swing and breaches a threshold.

What Are The Biggest Risks In A Stablecoin Strategy?

Even when you're focused on "safer" assets like stablecoins, risk never disappears. Thinking it does is a critical mistake. The main dangers you need to have on your radar are smart contract vulnerabilities, stablecoin de-pegging events, and sudden regulatory curveballs.

A hack or a bug in a protocol's code can lead to a total loss of funds. And if a stablecoin loses its 1:1 peg, the very foundation of your portfolio can crack.

The key to sleeping at night is diversification. Never, ever put all your funds into a single protocol, no matter how shiny or "safe" it seems. Spreading your capital across a mix of battle-tested protocols (like Aave and Compound) and different stablecoin types (like USDC and DAI) is your best defense against a single point of failure.

How Do I Account For Gas Fees In My Strategy?

Gas fees can be a real killer, especially on Ethereum mainnet. For smaller portfolios, they can easily turn a profitable strategy into a losing one. Any smart DeFi portfolio allocation has to think about these transaction costs from the get-go.

The most effective way to handle this is by moving your activity to Layer 2 solutions like Base, Arbitrum, or Optimism. Transaction costs on these networks are just a tiny fraction of what you'd pay on mainnet, which makes regular deposits and rebalancing actually make sense economically.

When you're mapping out your allocation, always estimate the costs of both setting up your positions and carrying out your rebalancing plan. For smaller amounts, it's often way more cost-effective to use an aggregator or simply rebalance less frequently to avoid getting eaten alive by fees.

Ready to put your stablecoin strategy on autopilot? Yield Seeker uses AI to automatically find and manage the best risk-aware yields for you, so you can earn more with less effort. Get started in minutes at https://yieldseeker.xyz.