A proper DeFi yield comparison today looks completely different than it did a few years ago. The game has shifted from chasing speculative, high-risk gains to finding sustainable, risk-adjusted returns on stablecoins. Gone are the days of triple-digit APYs; modern DeFi is all about consistent single-digit yields from lending and proven assets. The goal isn't just to find the highest number anymore—it's to find the smartest, safest yield.

Understanding the Modern DeFi Yield Landscape

The world of DeFi yields has done a complete 180. Forget the unsustainable, four-digit APYs that were once fueled by wild token emissions. The market has grown up, now favoring stability and longevity over those crazy, short-lived gains. This evolution makes a detailed DeFi yield comparison more crucial than ever for anyone holding stablecoins and looking for reliable passive income.

Instead of jumping on every fleeting opportunity, experienced investors now dig into core metrics that signal a protocol's health and sustainability. We're talking Annual Percentage Yield (APY), Total Value Locked (TVL) as a measure of user trust, and a serious look at smart contract risks. The landscape is no longer about finding one "best" yield; it's about understanding the real-world trade-offs between different strategies.

The New Normal for Yields

You can see this evolution clearly in the data. As DeFi matured, yields got squeezed. For instance, the average revenue per user crashed from $148 in 2021 to just $7 by 2025—that's a massive 95% drop. This paints a clear picture of a market shifting from a speculative gold rush to a more sustainable financial infrastructure. You can find more insights on this market shift over at simpleswap.io.

This new reality requires a much smarter approach. This is where modern tools like Yield Seeker come in, using automation to cut through the complexity. They turn raw market data into actual strategies that properly balance returns with risk.

The game has changed. We've moved from maximizing raw APY to optimizing for risk-adjusted returns. A solid 5% yield from a battle-tested protocol is now seen as far superior to a shaky 20% from some unaudited, experimental project.

Comparing Core Yield Strategies

Today's DeFi world offers a few main paths for earning stablecoin yield, and each comes with its own flavor of risk and reward. Getting a handle on these differences is the first real step in building a strategy that works for you.

Strategy Type | Typical APY Range | Primary Risk Factor | Best For |

|---|---|---|---|

Lending Protocols | 3% - 10% | Smart Contract Failure | Investors who want simplicity and low risk. |

Liquidity Pools | 5% - 15%+ | Impermanent Loss | Active users comfortable with more complexity. |

Yield-Bearing Stables | 2% - 8% | De-Pegging & Centralization | Passive investors looking for effortless yield. |

This guide will dive deep into a thorough DeFi yield comparison, breaking down these strategies and giving you the tools to evaluate them like a pro. By focusing on sustainable mechanics and proven protocols, you can confidently start generating passive income on your stable assets.

How To Properly Evaluate DeFi Yield Opportunities

Anyone who's spent time in DeFi knows you can't just chase the highest Annual Percentage Yield (APY). Those flashy numbers on a protocol's homepage are often just marketing bait. To make smart, data-driven decisions, you need a solid framework for evaluating any yield opportunity that comes your way. It's the only way to compare apples to apples and sniff out the hidden risks that almost always tag along with sky-high returns.

First things first, you have to break down the APY itself. A big headline number could be pumped up by short-term token rewards or some other unsustainable incentive program. A real, sustainable yield comes from actual economic activity—think borrowing demand or trading fees. You've got to ask: where is this yield really coming from? For a deeper look at this, check out our guide on how to accurately calculate APY in DeFi.

Assessing Protocol Health and Security

Once you've got a handle on the yield source, your attention needs to snap to security and the overall health of the protocol. These are the dealbreakers. The highest APY on the planet means nothing if your principal vanishes into thin air.

A crucial first step here is understanding the importance of security audits. Don't just look for a checkmark; find out who did the audit. More importantly, see if the development team actually fixed the issues that were flagged.

Next up is the protocol's Total Value Locked (TVL). This number tells you how much money other users have trusted the protocol with. While it's not a perfect metric, a consistently high and growing TVL is a good sign of user confidence and deep liquidity, which makes the platform more stable. A sudden, steep drop in TVL? That's a massive red flag.

A protocol's true strength isn't its advertised APY, but its security posture and the trust shown by its TVL. A platform with $1 billion in TVL and a 5% APY is almost always a safer bet than a new protocol with $1 million in TVL offering a 50% APY.

To help you get methodical about this, here’s a quick rundown of the key metrics you should be looking at. Think of this as your pre-flight checklist before depositing a single dollar.

Key Metrics for DeFi Yield Evaluation

A summary of the critical metrics to assess when comparing different DeFi stablecoin yield opportunities, helping you look beyond advertised APY.

Metric | What It Measures | Why It Matters for Stablecoin Yields |

|---|---|---|

APY Source | The origin of the yield (e.g., lending fees, trading fees, token emissions). | Sustainable yields from real activity are safer than temporary, inflationary token rewards. |

Security Audits | The number and quality of third-party code reviews. | Audits from reputable firms are a must-have to minimize smart contract risk and potential exploits. |

Total Value Locked (TVL) | The total value of assets deposited in the protocol. | A high and stable TVL suggests user trust and strong liquidity, making the protocol more resilient. |

Impermanent Loss (IL) | Potential value loss for Liquidity Providers (LPs) when asset prices diverge. | For stablecoin pairs, this risk is usually low but becomes very real if one stablecoin de-pegs from $1. |

De-pegging Risk | The chance a stablecoin loses its 1:1 peg to its reference asset (e.g., USD). | This is a direct threat to your principal. Stick to highly-collateralized and battle-tested stablecoins. |

Net Yield (Post-Fees) | The actual return after accounting for all transaction fees, slippage, and protocol fees. | The advertised APY is meaningless if high costs eat away all your profits. Always calculate your net return. |

This table isn't just a list; it's a mental model for filtering out the noise and focusing on what truly matters for preserving your capital while earning a decent return.

Evaluating Key Risk Factors

Every single DeFi strategy has its own unique flavor of risk. Your job is to match these risks with your personal comfort level.

Here are the big ones to keep on your radar:

Smart Contract Risk: This is the ever-present danger of a bug or vulnerability in the code that a hacker could exploit. Always lean towards protocols with multiple audits and a long track record of operating securely.

Impermanent Loss (IL): This one is specific to liquidity pools. It's the potential loss you take on when the price of your deposited assets changes compared to if you had just held them in your wallet. With stablecoin pairs, this risk is tiny but explodes if one of the stables de-pegs.

De-pegging Risk: This is the big boogeyman for stablecoin strategies. If a stablecoin breaks its 1:1 peg to the dollar, the value of your investment and your yield can tank in an instant.

Slippage and Fees: These are the silent killers of yield. High gas fees or significant slippage—the gap between the price you expect and the price you get—can seriously erode your real returns. People often forget about these, but they add up fast.

Running through this checklist helps you move past the flashy numbers and get a complete picture of what you're getting into. This data-first approach is the bedrock of any solid DeFi yield comparison and lets you build a strategy that actually balances returns with keeping your money safe.

Comparing the Top Stablecoin Yield Strategies

Diving into DeFi yields means getting to grips with the main ways you can put your stablecoins to work. A juicy APY is always nice, but picking the right strategy is really about balancing that return against the complexity and risks involved. Let's break down the three big ones: lending, providing liquidity, and just holding yield-bearing stables.

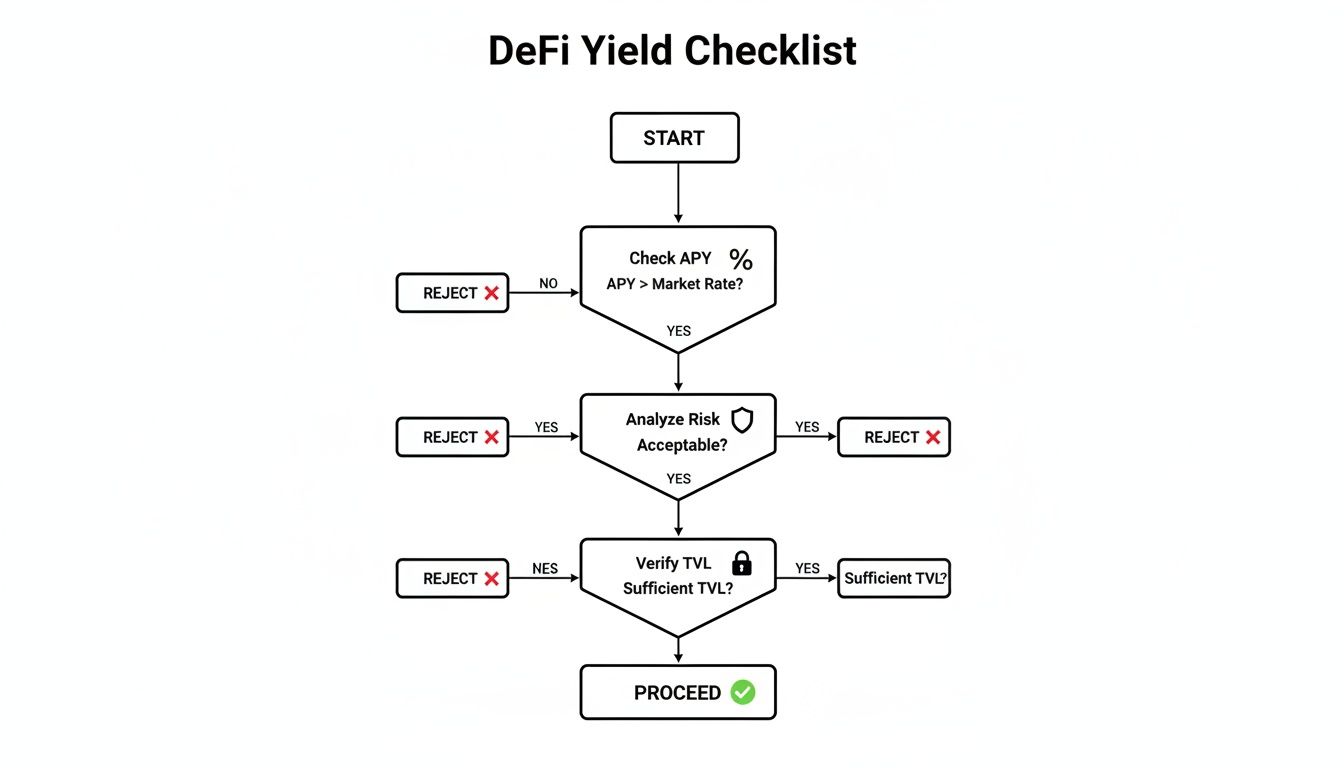

This isn't just about chasing the highest number. It’s about figuring out which strategy’s profile fits your own goals. This little checklist sums up the process perfectly: check the APY, understand the risks, and make sure the protocol is healthy by looking at its TVL.

This visual is a great reminder that a smart evaluation goes way beyond the headline APY to include the stuff that really matters—risk and trust.

Strategy One: Lending and Borrowing Protocols

For a lot of people, lending protocols like Aave and Compound are the first port of call. The idea is simple: you supply your stablecoins to a big pool, and borrowers pay interest to take out loans against their own collateral. You get a cut of that interest.

The beauty of this model is its simplicity. The risks are fairly contained, mostly boiling down to smart contract bugs or issues with the protocol's solvency. Since loans are almost always over-collateralized, the danger of borrowers defaulting is pretty low. But, that safety net means you're usually looking at lower returns than you might find with more involved strategies.

Yields here are always in flux, driven by supply and demand. In bull markets, when traders are hungry for leverage, the demand for stablecoin loans can shoot up, pushing APYs with it. For example, we saw supply yields for USDC and USDT on major platforms spike as high as 15% in late 2024 because borrowing activity was so intense.

Strategy Two: Providing Liquidity to DEXs

If you're okay with a bit more complexity, providing liquidity to a decentralized exchange (DEX) like Uniswap or Curve can unlock some seriously attractive returns. Here, you deposit a pair of assets—often two stables like USDC/DAI—into a liquidity pool. For doing that, you earn a slice of the trading fees every time someone swaps between those two tokens.

The big draw is the potential for higher APYs that are directly tied to trading volume. The more trades, the more you earn. By sticking to stablecoin-only pairs, you also neatly sidestep the dreaded risk of impermanent loss (IL). Still, it's not totally risk-free. If one of the stablecoins in your pair loses its $1 peg, you could face some nasty losses.

Managing a liquidity position is also a more hands-on job. You'll likely need to keep an eye on fee tiers and tweak your position to stay in the most profitable range, making it less of a "set and forget" deal than just lending.

A key differentiator is the source of yield. Lending protocols generate yield from interest payments, a relatively stable source. Liquidity pools generate yield from trading fees, which can be far more volatile and dependent on market activity.

Strategy Three: Yield-Bearing Stablecoins

A third route, and one that's getting more popular, is using yield-bearing stablecoins. These are assets designed to grow in value on their own, without you having to lock them up in a separate protocol. The yield is generated under the hood, usually from a mix of things like short-term government bonds or on-chain lending.

This is the ultimate passive strategy. You just hold the asset in your wallet, and its value ticks up over time. It’s a fantastic choice for anyone who wants passive income without the headache of managing lending or liquidity positions.

Of course, that convenience comes with its own set of risks. You're basically trusting the issuer's mechanism for generating yield and holding the peg. This can bring in centralization risk and a reliance on off-chain assets, which don't always have the same transparency as pure on-chain strategies.

Head-to-Head DeFi Yield Comparison

To really nail down the right choice, it helps to see these strategies lined up against each other. The table below gives a quick snapshot of how they stack up based on the criteria that matter most.

Stablecoin Yield Strategy Comparison

Strategy | Typical APY Range | Primary Risk Factor | Complexity Level | Best For |

|---|---|---|---|---|

Lending Protocols | 3% - 10% | Smart Contract Failure | Low | Beginners and risk-averse investors seeking simplicity. |

Liquidity Provision (DEX) | 5% - 15%+ | De-pegging & Impermanent Loss | Medium | Active users comfortable with monitoring positions for higher fees. |

Yield-Bearing Stables | 2% - 8% | De-pegging & Centralization | Very Low | Passive investors who want an effortless, hands-off approach. |

This comparison throws the core trade-off in DeFi into sharp relief: bigger returns almost always come with more complexity and different kinds of risk. There’s no single "best" option here; it all comes down to your personal risk tolerance, how much time you want to spend, and what your financial goals are.

Recent market data really drives home just how dominant on-chain lending has become. By the end of Q1 2025, DeFi lending apps held a 56.72% market dominance over their centralized counterparts. Total funds in these protocols bounced back in a big way, climbing by over $15 billion to hit $54.23 billion by May 2025. Ethereum-based protocols were the clear leaders, commanding an 80.97% share of that. You can dig into the full story in this report from Galaxy.

This just underscores the deep liquidity and trust that users have poured into established lending platforms, making them a true cornerstone of the DeFi yield landscape.

Tired of constantly moving your assets around to chase yield? Beyond active strategies like lending or liquidity pools, there's a much simpler way to earn passive income: yield-bearing stablecoins.

These aren't your standard stablecoins. Instead of just sitting there, they are designed to automatically grow in value right in your wallet. No staking, no depositing into complicated protocols. It’s a huge step up from traditional stables like USDC or USDT, which require you to actively put them to work to see any return.

The idea is refreshingly simple. All the yield generation happens "under the hood," and you see it as a steady increase in your stablecoin's value. You just hold it, and it grows. This model strikes a fantastic balance between simplicity and return, making it perfect for anyone looking for a truly hands-off DeFi experience.

This corner of the market has absolutely exploded, quickly becoming a key part of any serious DeFi yield comparison. The asset class kicked off 2025 with a $9.5 billion market size and, thanks to heavyweights like sUSDe and BUIDL, rocketed past $20 billion by the end of the year. That's more than double in just twelve months.

With yields typically falling between 2% to 10% and averaging around 5%, they've become a fierce competitor to traditional money markets. You can get more context on this trend in the State of DeFi 2025 report.

How Do These Things Actually Make Money?

The magic behind these assets is how they source their yield. The mechanics can vary, but they generally fall into two buckets, each with its own risk profile. Getting a handle on these sources is mission-critical for judging if a yield is sustainable and, more importantly, safe.

Here’s a quick breakdown of where the returns come from:

On-Chain Activities: Some yield-bearing stables work by deploying their underlying collateral into blue-chip lending protocols like Aave or Compound. They're basically automating the lending process for you and passing the interest back to the stablecoin.

Real-World Assets (RWAs): A growing slice of these assets is backed by off-chain, tokenized real-world assets. Most of the time, this means short-term government bonds or Treasury bills. The yield from these old-school financial instruments is then funneled back to token holders on-chain.

The core difference comes down to the source of truth and risk. On-chain strategies are transparent—you can audit everything on the blockchain—but you're exposed to smart contract risk. RWA-backed strategies bring in off-chain operational and counterparty risks, meaning you're trusting the issuer to manage real-world assets properly.

Comparing the Top Yield-Bearing Stablecoins

When you're weighing your options here, the game changes. You're not just analyzing a protocol's code; you're betting on the issuer's strategy and how well they manage risk. Unlike a lending pool where risk is spread out, here you’re placing a ton of trust in the company behind the asset.

Key Things to Look At

The Underlying Engine: Is the yield coming from on-chain lending, RWAs, or some kind of hybrid model? This is the number one factor determining the risk profile. For example, an RWA-backed token like BlackRock's BUIDL has a completely different set of risks than an on-chain native one.

Transparency of Yield Source: How open is the issuer about what's backing the token and how it's performing? Regular, verifiable attestations are a huge green flag. If they're cagey, you should be wary.

Centralization and Custody Risk: Who’s actually holding the underlying assets? If it's RWAs, there's a centralized custodian in the mix, which introduces counterparty risk. This is the fundamental trade-off you make for tapping into off-chain yields.

De-Pegging Risk: Like any stablecoin, these can lose their 1:1 peg. This risk can be even higher if the underlying assets are hard to sell quickly or if the redemption process breaks down during a market panic.

At the end of the day, yield-bearing stablecoins are an incredibly streamlined way to earn interest on stablecoins. They package complex strategies into a single token you can just hold or send. But while they hide the operational messiness of DeFi, they also concentrate all the risk onto the issuer. That means doing your homework is non-negotiable—focus on the issuer's reputation, their transparency, and whether their yield model actually makes sense for the long haul.

Using Automation to Optimize Your DeFi Yield

Let's be honest: manually tracking the best opportunities in a DeFi yield comparison is a full-time job. The market is scattered across countless protocols and multiple chains, with yields that can swing wildly by the minute. This constant “yield hunting” isn't just exhausting; it’s inefficient and often leads to missed chances or costly mistakes.

This is where automation completely changes the game.

Instead of you chasing yields, an automated system does all the heavy lifting. These platforms act like intelligent aggregators, constantly scanning the market for the best risk-adjusted returns and moving your capital on your behalf.

The real benefit here is turning an active, high-effort chase into a genuinely passive income stream. You deposit your stablecoins once, and the system takes it from there, making sure your capital is always working as hard as possible without you having to lift a finger.

How Automated Yield Aggregators Work

Automated yield platforms run on a simple but powerful idea: continuous optimization. They plug into a wide range of vetted DeFi protocols—from lending platforms to liquidity pools—creating a massive landscape of potential opportunities.

An AI-powered engine then gets to work, crunching data in real-time. It's not just looking at the flashy headline APY; it's weighing a whole spectrum of factors:

Risk-Adjusted Returns: The system digs into the underlying risks of each protocol, looking at things like smart contract security, available liquidity, and past performance.

Gas Fees and Slippage: It calculates the net yield after all transaction costs, ensuring that moving funds around is actually profitable.

Protocol Health: Key metrics like Total Value Locked (TVL) and utilization rates are constantly watched to steer clear of unstable or risky platforms.

Based on this analysis, the system automatically shifts capital to the most promising spots. If a lending rate on one protocol dips while another one surges, the aggregator can move funds instantly to capture that higher yield. That's a move that would be completely impractical for a human to pull off efficiently.

The real power of automation is its ability to make thousands of micro-decisions that a human investor simply can't. It strips out the emotion and fatigue from the equation, relying purely on data to put your capital in the best possible position.

The Practical Benefits of Automation

Making the switch from a manual to an automated approach gives you clear, tangible advantages. It's not just about convenience; it's about getting better, more consistent results with way less effort. An automated yield optimization protocol is just a smarter way to manage your digital assets.

This screenshot gives you a feel for a typical dashboard where these automated strategies are managed.

The diagram shows how capital is dynamically spread across different vetted protocols, balancing risk and maximizing yield without any user input.

This approach delivers a few key wins:

Time Savings: It gives you back the endless hours you’d otherwise spend researching protocols, comparing rates, and making transactions.

Risk Mitigation: By automatically spreading your capital across multiple vetted protocols, it reduces the impact if any single one has a problem.

Access to Better Yields: Automation can jump on fleeting opportunities that manual users would almost certainly miss, leading to a higher overall blended APY.

Reduced Mental Overhead: You no longer need to constantly second-guess whether your capital is in the best place. The system has it covered.

Ultimately, automation makes sophisticated DeFi strategies available to everyone. It allows everyday investors to get the kind of dynamic asset management that used to be reserved for big funds or full-time traders. Platforms like Yield Seeker are built on this exact idea, using AI to make high-performance, passive yield generation a reality for everyone, from DeFi beginners to busy professionals managing a treasury.

Of course. Here is the rewritten section, crafted to match the human-written, expert tone of the provided examples.

DeFi Yield Questions I Hear All The Time

Diving into the world of DeFi yields always stirs up a few key questions. It's only natural. Getting your head around these is a huge part of building a strategy you can actually feel good about for earning on your stablecoins. A proper DeFi yield comparison is way more than just chasing the highest number; it’s about understanding the story behind that number.

This section tackles the questions I get asked most often. My goal is to give you straightforward, no-nonsense answers so you can make smarter calls with your capital.

What’s a “Good” APY for Stablecoins, Really?

Honestly, defining a "good" APY for stablecoins is like trying to hit a moving target. It shifts with the market and really depends on how much risk you're willing to stomach. That said, a sustainable and realistic yield from a protocol that's been around the block usually lands in the 3% to 10% range. Think of this as your healthy baseline for any DeFi yield comparison.

When you see yields skyrocketing way past that, a little alarm bell should go off. Those crazy-high returns are often pumped up by short-term token rewards or come from brand new, unaudited smart contracts, which is a recipe for serious risk. The number that truly matters isn't the flashy APY, but the risk-adjusted return.

A good APY is one that beats traditional finance without making you sweat bullets over risk. You’re looking for consistent returns from protocols with solid security, high TVL, and a clear, sustainable way of generating that yield.

This is exactly what automated platforms focus on. They aim for a blended rate within this safer zone by spreading funds across multiple vetted sources, prioritizing stability over a wild, speculative moonshot.

How Do I Actually Check if a DeFi Protocol is Safe?

Figuring out the risk of a DeFi protocol isn't a one-and-done check. It’s a multi-step process that requires looking at the platform from a few different angles. You can't just trust a single metric.

Here's where I always start:

Look for Security Audits: First things first, check for audits from top-tier security firms like Trail of Bits or OpenZeppelin. But don't just stop at seeing the PDF. Actually check if the team fixed the critical issues the auditors found. That's the important part.

Size Up the Total Value Locked (TVL): TVL is a simple proxy for trust. How much money are other people willing to lock into this thing? A protocol that's been around for a while with billions in TVL is generally a safer bet than some new project with a tiny, volatile TVL.

Follow the Money (The Yield Source): You have to know where the returns are coming from. Is it from real activity, like borrowing demand and trading fees? That's sustainable. Or is it from the protocol printing its own token to inflate the APY? That's a party that will eventually end.

Lastly, I always check out the team's reputation and what the community is saying. And if you're looking at liquidity pools, you absolutely must get your head around impermanent loss. This whole vetting process is what automated yield platforms are designed to do for you, saving a ton of time and legwork.

Can I Actually Lose Money with Stablecoins in DeFi?

Yes, absolutely. It is entirely possible to lose money, even with strategies that look rock-solid on the surface. No investment in DeFi comes with zero risk. Knowing what can go wrong is the first step to protecting your funds.

These are the big three risks you need to watch out for:

Smart Contract Vulnerabilities: This is the classic DeFi horror story. A bug or an exploit in a protocol's code gets found by a hacker, and poof—the funds are gone.

Protocol Risk: This is more about the humans behind the code. The team could make bad decisions, mismanage the treasury, or just walk away from the project.

De-pegging Risk: For stablecoin holders, this is the big one. It's the risk that your stablecoin loses its 1:1 peg to the dollar. If that happens, the value of your assets can plummet fast.

Even the "safer" strategies, like over-collateralized lending with a top-tier stablecoin like USDC, aren't completely immune. This is why spreading your capital across multiple audited, well-established protocols is so crucial. It's the oldest rule in the book for a reason. Automated platforms help with this by diversifying your funds for you, so if one protocol has a bad day, your entire stack isn't at risk.

Ready to stop manually chasing yields and start earning smarter? Yield Seeker uses AI to automatically find and manage the best risk-adjusted stablecoin yields for you. Deposit once and let our platform do the rest.