Getting into Decentralized Finance (DeFi) is an incredible way to earn yield on your crypto, but let’s be real—it's also packed with hidden dangers. Every protocol is built on smart contracts, which are just pieces of code. And like any software, they can have bugs, flaws, or backdoors that hackers love to exploit.

The stakes are sky-high, since these contracts often hold millions, sometimes billions, of dollars. This is exactly where smart contract risk scoring becomes your best friend. Think of it as a credit score for a DeFi protocol. It’s a simple, number-based rating that gives you a quick snapshot of its potential weak spots and overall health.

Instead of needing to be a security wizard yourself, you can use a risk score as a first filter. It helps you quickly tell the difference between a solid-looking protocol and one that might just be a ticking time bomb.

A risk score isn't just a random number, either. It’s the result of a deep dive into multiple layers of a protocol's design. It's like a full medical check-up for a DeFi app, where the final score is pulled from lots of different tests, each one looking at a specific part of its health.

The Alarming Reality of DeFi Exploits

The need for a good risk scoring system isn't just a "nice-to-have." The DeFi world is a graveyard of projects that got hacked, leading to massive losses for users. As more money gets locked into DeFi, the bigger the target on its back becomes.

By mid-2025, a mind-boggling $2.17 billion was stolen in crypto hacks, and smart contract exploits are still one of the main culprits. These numbers are a harsh reminder of why we need better tools to check the risks before we dive in. You can dig into more stats on this in SQ Magazine's report on institutional crypto risk.

Just take a look at this snapshot from DeFiLlama. It shows the crazy amounts of money—Total Value Locked (TVL)—stashed away in different DeFi protocols.

Every single protocol on that list is a potential target. The massive TVL numbers just hammer home how much is at stake and why doing your homework is so important.

Key Components of a Smart Contract Risk Score

So, what's actually under the hood of these risk scores? While every platform has its own secret sauce, they all tend to look at a similar set of core factors. Getting a feel for these components helps you see beyond the final number and understand what’s really going on with a protocol’s security.

Here’s a simple breakdown of what usually goes into a risk score:

Component | What It Measures | Example Signal |

|---|---|---|

Code Security & Audits | The quality and robustness of the smart contract code itself. | Presence of known vulnerabilities like reentrancy, integer overflows, or a recent audit from a top-tier security firm. |

On-Chain Activity | Real-time transaction patterns and signs of market manipulation or centralization. | High concentration of tokens in a few wallets, or unusual transaction volumes that could signal wash trading. |

Team & Governance | The trustworthiness of the team and the security of their administrative controls. | Anonymous team, lack of a multisig wallet for treasury funds, or no timelock on critical contract upgrades. |

Economic & Oracle Risk | How resilient the protocol is to price manipulation and external data failures. | Heavy reliance on a single, unaudited price oracle or a token model that can be easily manipulated. |

These components come together to paint a holistic picture of a protocol's security. It's not just about the code; it’s about everything that surrounds it.

A strong risk score is more than just a passing grade on a code audit; it’s a reflection of a project's holistic commitment to security, transparency, and safe operational habits.

Ultimately, a smart contract risk score is a powerful piece of the puzzle when you're doing your research. It helps you make smarter decisions, navigate the wild west of DeFi more safely, and keep your funds away from obvious threats.

How Risk Scores Are Actually Calculated

A smart contract risk score isn’t just pulled from thin air. It’s the result of a multi-layered investigation that combines several different analytical techniques. Think of it like a detective using various tools to solve a case—each method uncovers a different type of clue. By blending these approaches, risk scoring platforms create a much more accurate and reliable picture of a protocol's true security posture.

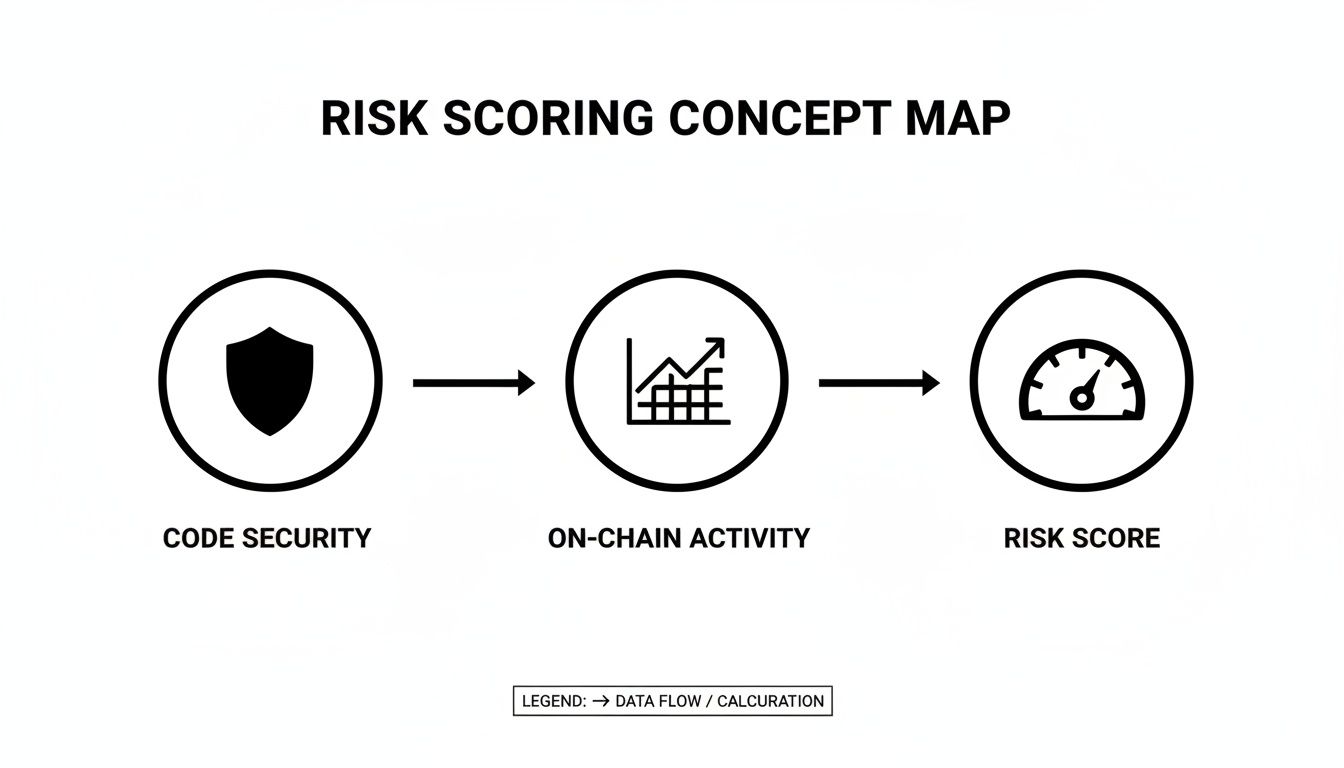

The entire process moves from the theoretical (the code itself) to the practical (how that code actually behaves in the wild). This makes sure the final score reflects both the smart contract's original design and its real-world performance.

This flowchart gives you a high-level view, showing how code security analysis and on-chain activity monitoring come together to produce a final risk score.

As you can see, a comprehensive risk score isn't based on a single factor. It's a blend of multiple data streams, providing a much richer, more nuanced assessment.

Static Analysis: The Code Scanner

The first and most fundamental method is static analysis. You can think of this as running a sophisticated spell-checker and grammar checker over the smart contract's source code before it’s even deployed. This automated process scans every single line of code without actually executing it.

Its main job is to hunt for known vulnerabilities and sloppy coding practices. It’s fantastic at catching common but costly mistakes that developers might otherwise miss.

Here’s what static analysis typically looks for:

Known Attack Patterns: It flags code structures that are susceptible to classic exploits like reentrancy or integer overflows.

Outdated Compilers: Using an old version of the Solidity compiler can introduce known security holes.

Logical Flaws: It can sometimes spot basic logic errors, like functions that don't behave as intended.

While incredibly useful for catching the low-hanging fruit, static analysis has its limits. It can’t understand a developer's intent or spot complex economic exploits that depend on market conditions. It's a crucial first line of defense, but it’s definitely not the whole story. Many automated risk assessment tools begin with this foundational step. To explore these further, you can find a detailed breakdown in our guide on automated risk assessment tools.

Formal Verification: The Mathematical Proof

If static analysis is a grammar check, then formal verification is a rigorous mathematical proof. This is the most intense and complex form of code analysis out there, where a smart contract's behavior is modeled and proven to meet a specific set of rules.

Formal verification doesn't just check for bugs; it mathematically proves their absence under all possible conditions. It’s the gold standard for mission-critical contracts where failure is not an option.

This method is extremely powerful, but it’s also incredibly resource-intensive. It requires specialized expertise and a significant amount of time, which is why it's typically reserved for core protocol components or contracts handling immense value. It’s the best way to prevent logic bugs and ensure the contract functions exactly as designed, leaving no room for unexpected edge cases.

On-Chain Heuristics: The Live Market Analyst

Once a contract is live on the blockchain, its risk profile changes. On-chain heuristics involve analyzing the contract's real-time transaction history and interactions. This is like a market analyst watching stock trading patterns to spot signs of insider trading or manipulation.

This method focuses on behavioral and market-related risks that static analysis just can't see.

Key signals monitored include:

Wallet Concentration: Are a few wallets holding a massive percentage of the project's tokens? This signals centralization risk.

Transaction Volume: Sudden, unusual spikes in transaction volume could indicate wash trading or an ongoing exploit.

Governance Activity: How are administrative powers being used? Are there suspicious, last-minute changes to the protocol?

On-chain analysis is absolutely essential for a dynamic smart contract risk scoring system because it reflects what’s happening right now, not just what the code says should happen. For a deeper dive into the metrics and standards used in quantifying vulnerabilities, check out these vulnerability management best practices, including CVSS scoring.

Oracle-Driven Metrics: The External Data Check

Finally, many DeFi protocols rely on external data sources called oracles to function—for example, to get the current price of Ethereum. Oracle-driven metrics evaluate the security and reliability of these external dependencies.

This is like checking the sources of a news report. If the source is unreliable, the entire report becomes questionable, no matter how well-written it is. A protocol might have flawless code, but if it relies on a single, easily manipulated oracle, it remains highly vulnerable. This method assesses things like oracle decentralization, data update frequency, and fail-safes.

By combining these four methodologies, a robust risk score is born. It provides a holistic view that covers the code's design, mathematical correctness, live behavior, and external dependencies.

Here's a quick table to summarize how these different approaches stack up against each other.

Comparison of Risk Scoring Methodologies

This table offers a comparative look at the primary methods used to generate smart contract risk scores, highlighting their pros, cons, and best use cases.

Methodology | Primary Strength | Key Limitation | Best For Detecting |

|---|---|---|---|

Static Analysis | Speed and automation; catches common coding errors | Lacks context; can't detect novel or economic exploits | Known vulnerabilities, bad practices, version issues. |

Formal Verification | Mathematical certainty; proves absence of bugs | Extremely time-consuming and expensive | Critical logic flaws, contract invariant violations. |

On-Chain Heuristics | Real-time and dynamic; reflects actual behavior | Reactive; may only flag issues after they start | Market manipulation, centralization, unusual activity. |

Oracle-Driven Metrics | Assesses external dependencies vital for DeFi | Limited to protocols that rely on oracles | Oracle manipulation risk, data feed reliability. |

As you can see, no single method is perfect. Each has its own strengths and blind spots. That’s why the most reliable risk scores come from a blend of all four, creating a much more complete and trustworthy picture of a protocol's safety.

What Kinds of Threats Are We Looking For?

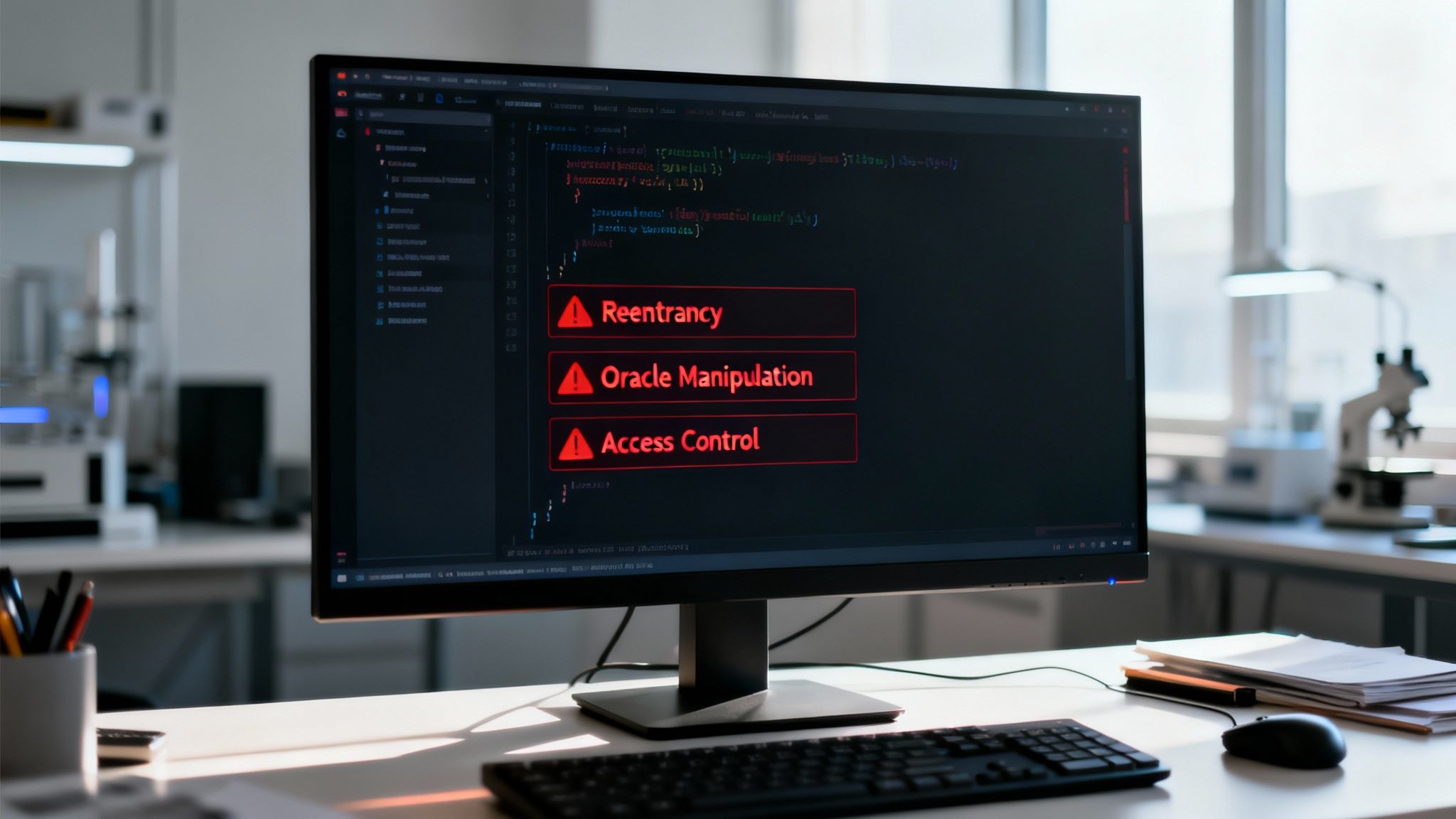

Knowing how risk scoring tools work is one thing, but to really get why they matter, we need to look at the monsters they're designed to find. Think of this as a field guide to the nastiest, most common bugs lurking in the shadows of DeFi protocols.

Once you can spot these critical vulnerabilities, a risk score stops being just a number and starts telling you a story about a protocol's real-world safety. These aren’t just abstract coding problems; they're the very loopholes that have cost users billions of dollars.

Reentrancy: The Classic DeFi Heist

One of the most legendary exploits is the reentrancy attack. Imagine a buggy ATM that lets you keep withdrawing cash before it gets around to updating your balance. You could empty the machine because it does things in the wrong order—it should update your balance before dispensing more cash.

A reentrancy attack follows the same logic. An attacker's contract calls a function, like withdraw(). But before that function finishes and updates the state (like lowering the attacker's balance), the malicious contract jumps back in—or "re-enters"—and calls it again. This loop runs over and over until the protocol is completely drained.

The infamous 2016 DAO hack, which siphoned off over $60 million in Ether, was a textbook reentrancy attack. The fallout was so massive it actually forced a hard fork of the entire Ethereum blockchain.

Luckily, modern risk scoring tools are very sharp when it comes to spotting code patterns vulnerable to reentrancy. It’s a basic, non-negotiable check in any real security analysis.

Oracle Manipulation: When the Price Isn't Right

Lots of DeFi protocols rely on outside data feeds, called oracles, to pull in real-world info like the price of ETH or USDC. But what if that data feed gets poisoned? That’s oracle manipulation risk in a nutshell.

If a protocol leans on a single, centralized, or easily swayed price oracle, an attacker can feed it bad data. For example, they might use a massive flash loan to temporarily warp the price of an asset on a small, illiquid decentralized exchange that the oracle is watching.

With that fake price, the protocol can be tricked into doing all sorts of disastrous things:

Handing out loans with no real collateral.

Letting attackers buy up assets for pennies on the dollar.

Unfairly liquidating honest users' positions.

A solid smart contract risk scoring system will always dig into a protocol’s oracle setup, flagging any that aren't decentralized or robust enough to withstand manipulation.

Flawed Access Controls: Leaving the Keys Under the Mat

This one is maybe the simplest, yet most devastating, vulnerability of all: flawed access control. It’s the digital equivalent of leaving the bank vault unlocked or taping the keys to the front door.

This happens when a smart contract doesn’t properly gatekeep its most powerful functions. When anyone can call administrative functions—like upgrading the contract, pausing all activity, or sweeping all user funds into a different wallet—it’s only a matter of time before someone does.

This isn’t just a theoretical problem; it’s the number one cause of financial loss in DeFi today. In fact, Access Control Vulnerabilities are ranked as the top smart contract risk in the OWASP Smart Contract Top 10 for 2025, responsible for a jaw-dropping $953.2 million in losses from documented hacks. Attackers simply find these unlocked functions and help themselves to the treasury.

Automated tools can struggle to catch these kinds of logic flaws, which is why manual code reviews are still so important. To really find these gaps, you need a human eye that understands best practices for thorough security code reviews. These manual checks are a cornerstone of any legitimate smart contract security audit, which you can read more about in our detailed guide. By getting familiar with these big three threats, you start to see why risk scores are such an essential tool for staying safe in DeFi.

How to Read and Use Risk Scores in Your Research

So you've got a smart contract risk score. Is it just a pass/fail grade? Thinking like that is a huge mistake. A risk score isn't the final answer; it's a compass pointing you where to start your own digging. It’s your first step, not your last.

A high score can give you some peace of mind, sure, but it's no substitute for your own judgment. On the flip side, a low score isn't an automatic "scam" label, but it’s a massive blinking red light telling you to be extremely careful. The real magic happens when you look past the number and understand why it is what it is.

Look Beyond the Final Number

The very first thing you should do with any smart contract risk score is break it down. Most good scoring tools don't just give you a single number; they offer sub-scores for different areas like code security, on-chain health, team reputation, and how much they rely on oracles. This is where the real intel is hiding.

Let’s say a protocol has a stellar code security score but tanks on wallet concentration. What does that tell you? The code itself is probably solid, but a handful of whales could easily dump the token or mess with governance votes. That kind of insight is way more useful than a single, blended score.

Always ask yourself these questions:

What are its biggest strengths? This shows you what the team has prioritized.

Where are the weakest spots? This is where you need to focus your research.

Am I okay with these specific weaknesses? A degen hunting for 100x gems has a very different risk appetite than someone just trying to earn a steady yield on their stablecoins.

Your Practical Due Diligence Checklist

Once you've got the sub-scores guiding you, it’s time to get your hands dirty and start verifying things yourself. Think of this as your personal checklist for kicking the tires on any protocol, using the risk score as your map.

Here’s a simple process you can run through for any DeFi protocol you're looking at.

Actually Read the Audit Report: A good score is often propped up by a security audit, but not all audits are created equal. Don't just see the "audited" stamp and move on.

Check the Date: Is the audit from last month or two years ago? If the code has changed a bunch since the audit, it's practically useless.

Verify the Scope: Did they audit the exact smart contracts you’ll be putting your money into? Sometimes projects only audit the less important parts to get the badge.

Review the Findings: Hunt for any "critical" or "high-severity" issues. Did the team actually fix them? A report full of unresolved critical issues is a deal-breaker.

Investigate On-Chain Centralization: Fire up a blockchain explorer—this is where you become a detective. You need to see who really holds the power.

Token Distribution: Check out the top token holders. If the top 10 wallets control over 50% of the supply, that’s a huge red flag for centralization.

Admin Keys: Who has the keys to the castle? The best-case scenario is a multisig wallet controlled by known, reputable people or a true DAO. If a single anonymous wallet has admin control, run.

Confirm Critical Security Features: These are the safety nets that protect you from getting rugged or drained. They are non-negotiable.

Timelocks: Is there a delay on major changes, like upgrading a contract or hiking up fees? A timelock gives everyone a heads-up and time to pull their funds if they don’t like an upcoming change. No timelock means the devs can change the rules instantly.

Governance Process: How are decisions made? A clear, transparent governance process is a great sign. If it's all happening behind closed doors, you have to wonder what they're hiding.

A risk score is a snapshot in time, but a protocol's security is a moving target. Use the score to inform your questions, not to provide all the answers.

By following this kind of structured approach, you turn a simple number into a powerful research tool. It empowers you to make smarter calls, navigate DeFi more confidently, and keep your capital safe from risks that are entirely avoidable.

The Limitations and Blind Spots of Risk Scoring

While smart contract risk scores are a massive help for getting a quick first look, you've got to understand they aren't foolproof. Think of them as a powerful filter for spotting obvious dangers and sorting through opportunities, but relying on them as your single source of truth is a recipe for disaster. No matter how smart an automated system is, it has blind spots that a sharp investor needs to know about.

Treating a high score as an unconditional green light is a rookie mistake. It completely misses the nuances that automated tools just can't see. A risk score is a snapshot in time, not a crystal ball. It’s great at summarizing known data and patterns, but it can't predict brand-new attack methods or account for the messy, off-chain human factors that can bring a whole protocol crashing down.

A smart contract risk score is like a weather forecast. It gives you a highly educated guess based on current data, but it can't guarantee there won't be a sudden, unexpected storm. Healthy skepticism is your best umbrella.

Getting this is crucial. Use the score to kick off your own digging, not to make a final judgment.

When Automated Tools Fall Short

One of the biggest blind spots for any automated scoring tool is complex business logic flaws. These aren't simple coding mistakes like a reentrancy bug; they're much deeper, more subtle problems baked into the economic design of a protocol. A scanner can check that a function runs as it's supposed to, but it has a hard time understanding why it was designed that way or how it could be twisted and exploited under wild market conditions.

For example, a tool might confirm a lending protocol’s liquidation function works perfectly fine. What it probably won't flag is that the protocol's collateral factor for a super volatile, thinly traded asset is dangerously high. That's a systemic risk bomb waiting to go off, and it’s the kind of thing only a human auditor with deep DeFi experience would likely catch. These are the exact vulnerabilities that lead to catastrophic failures when the market goes haywire.

Gaming the System for a Deceptive Score

Maybe the most dangerous limitation is that malicious developers can, and do, deliberately "game the system." Because the rules for many scoring models are out in the open, a bad actor can build a contract that checks all the right boxes to get a shiny high score while hiding a backdoor in plain sight.

This can happen in a few ways:

Forking Audited Code: A classic trick. They'll copy the code of a well-known, audited protocol like Uniswap or Aave. This lets them piggyback on a solid security reputation while slipping in a tiny, malicious change that automated tools might glide right over.

Superficial Compliance: A developer might add basic security features like a timelock but set the delay to zero, making it totally useless. The scoring tool just sees the feature exists and awards points, even though it offers zero real protection.

Hidden Centralization: The contract might look decentralized on the surface, but the team could keep total control through a proxy contract or a single wallet with god-mode privileges. The score looks great, but the rug-pull risk is off the charts.

These blind spots hammer home a critical point: no automated score can ever replace thorough, manual due diligence. The best way to approach smart contract risk scoring is to use the number to guide your own research. Verify their claims, poke around the code, and never trust a score without understanding the story behind it. This bigger picture view is the only way to move through DeFi safely.

The Future of DeFi Security: AI and Automation are Changing the Game

The next big leap in smart contract risk scoring isn't about more audits; it's about moving into real-time, predictive analysis driven by artificial intelligence. Let's be honest, traditional security methods are mostly reactive. They find vulnerabilities after they've already been coded into a protocol. AI flips that script, proactively monitoring enormous on-chain datasets to spot the subtle signals of a threat before it can ever strike.

Imagine an AI that's got its eyes on every single transaction, every governance vote, and every liquidity shift across thousands of protocols at once. That's not science fiction—it's the future of keeping DeFi safe. By catching tiny deviations from normal activity, these systems can flag potential exploits, weird market manipulation, or creeping centralization risks way faster than any team of human analysts could hope to.

This approach transforms risk scoring from a static, periodic check-up into a living, breathing, 24/7 monitoring system.

Putting AI-Driven Security Into Practice

This evolution isn't just a concept; it's already happening. Forward-thinking platforms are now blending third-party risk scores with their own proprietary AI models. This creates a security layer that's both dynamic and incredibly responsive, combining the solid foundation of audits with the predictive edge of machine learning.

Take a platform like Yield Seeker, for example. It uses this exact hybrid approach to automate how it allocates capital. Here’s a peek under the hood:

Data Ingestion: The system pulls in a constant stream of security scores, audit reports, and live on-chain data from a huge range of protocols.

AI Analysis: A custom-built AI model crunches all this blended data, identifying patterns and calculating a forward-looking risk assessment in real time.

Automated Action: Based on this continuous analysis, the platform automatically moves funds to opportunities that hit its strict security and yield benchmarks, pulling capital away from protocols that start showing early signs of trouble.

This automated process is the ultimate expression of smart contract risk scoring. Instead of the scores just informing a manual decision, they become direct inputs for a system that actively protects and grows your capital around the clock.

This kind of AI-driven automation doesn't just make things safer; it brings a level of vigilance that’s simply impossible to achieve by hand. We're seeing the same ideas pop up in other areas of security, too, like the push for more automation in bug bounty programs, which is helping developers find and fix vulnerabilities faster than ever before.

Got questions about risk scores? You're not alone. Even after you get the hang of how they work, figuring out how to use them in the real world can be tricky. Let's tackle some of the most common ones.

What Is a Good Smart Contract Risk Score?

Honestly, there's no magic number that works for everyone, but most scoring tools use a simple 0-100 scale. Here’s a rough guide to what those numbers usually mean:

90-100 (Excellent): This is the top tier. We're talking about protocols that are battle-tested, have been through multiple top-notch audits, and show strong, healthy activity on-chain. Think of the big, established players in DeFi.

70-89 (Good): A solid score. These protocols generally have their security in order but might have a few minor quirks. Maybe their audit history isn't as extensive, or there's a bit of centralization in their governance. Nothing alarming, but not perfect.

Below 70 (Tread Carefully): This is where the red flags start popping up. A score in this range could mean anything from unaudited code and anonymous teams to known vulnerabilities or serious centralization risks.

While a "good" score really depends on your own comfort with risk, dipping into protocols scoring below 70 is a gamble most people probably shouldn't take.

Can a High Score Guarantee a Protocol Is Safe?

Absolutely not. Let's be crystal clear about this: a high score is a fantastic sign, but it is never a guarantee. It tells you a protocol has passed a bunch of automated checks and is likely following security best practices.

A risk score is a probability check, not a crystal ball. It helps weed out the obvious, known risks but can't predict a brand-new type of exploit, a rogue team, or a sudden market crash.

Think of it like a five-star safety rating on a car. It significantly lowers your chances of getting hurt in a crash, but it can't prevent every single accident out on the road. Always treat a high score as one piece of the puzzle, not the whole picture.

How Often Should Risk Scores Be Updated?

It really depends on what's being measured. For something like static code analysis, the score might only change when the developers push a contract upgrade.

But for the dynamic stuff—the metrics that track what’s happening on-chain right now—scores should be updated constantly. Things like wallet concentration, transaction volumes, and governance votes are always changing. For a smart contract risk scoring system to be truly useful, it needs to reflect a protocol's health today, not just how it looked on launch day. Real-time monitoring is the gold standard here.

Ready to stop guessing and start earning smarter? Yield Seeker uses AI-driven risk analysis to automatically find and manage the best stablecoin yield opportunities for you.

Start earning with your personalized AI Agent today at Yield Seeker.