Stablecoins offer a compelling bridge between traditional finance and the crypto world, providing price stability while unlocking new avenues for capital efficiency. But with the DeFi landscape constantly evolving, manually chasing the best yields is a full-time job fraught with complexity and risk. A sophisticated new generation of stablecoin income tools has emerged to automate strategies, optimize returns, and simplify the user experience. These platforms solve a critical problem: they make earning passive income on your digital dollars both accessible and efficient.

This guide gets straight to the point, cutting through the noise to help you find the best tool for your specific goals. Whether you are a DeFi beginner seeking a simple on-ramp, an experienced investor looking to maximize efficiency, or a Web3 team managing a treasury, the right platform can transform how you earn. We will explore a curated list of 12 top-tier platforms, from foundational money markets like Aave and Compound to advanced, AI-driven aggregators like Yield Seeker.

Each entry is structured for quick evaluation, providing a clear overview of its function, target user, and risk profile. You will find actionable insights, screenshots for a visual preview, and direct links to get started immediately. Forget endless research; this resource is your shortcut to identifying the most effective stablecoin income tools available today. We will cover everything from simple USDC rewards on Coinbase to complex, fixed-rate protocols like Notional Finance, ensuring you have the information needed to make an informed decision and put your stablecoins to work safely.

1. Yield Seeker

Yield Seeker stands out as a premier AI-first platform meticulously engineered to automate stablecoin yield farming. It presents a robust and intelligent solution for users looking to generate passive income from their stablecoins without the constant burden of manual research and portfolio management. The platform’s core strength lies in its personalized AI Agent, which actively monitors and allocates capital in real time across a vetted selection of DeFi protocols on the Base chain. This automated approach is designed to secure competitive, risk-aware returns, making it an exceptional choice among stablecoin income tools.

The platform is engineered for accessibility and a frictionless user experience. Its low barrier to entry is a significant advantage; users can begin with as little as $10 USDC. This commitment to accessibility is further reflected in its user-centric policies: funds remain liquid and accessible at all times, with no lockups or withdrawal fees. This flexibility empowers users with full control over their capital, a critical feature in the fast-moving DeFi landscape.

Why Yield Seeker Excels

Yield Seeker masterfully combines cutting-edge automation with a strong focus on user education and security. The platform's design philosophy caters to a broad spectrum of users. Beginners benefit from a clean dashboard, visual walkthroughs, and step-by-step guides, while advanced users can leverage a built-in terminal for deeper analysis.

The platform’s credibility is reinforced by its experienced founders and positive testimonials from respected figures in the crypto space, including Zeneca and Seedphrase. This social proof underscores the trust early users have placed in the team's technical expertise and transparent approach. For those interested in the mechanics behind its automated strategies, Yield Seeker provides excellent resources on how it functions as a next-generation yield aggregator in crypto.

Key Information

Best For: Stablecoin holders, time-constrained investors, DeFi beginners, advanced users seeking automation, and Web3 teams managing treasuries.

Key Features: AI-driven real-time allocation, non-custodial architecture, zero lockups or withdrawal fees, low minimum deposit, and educational tools.

Integrations: Currently focused on USDC on the Base blockchain.

Risk Profile: Inherent smart contract and DeFi protocol risk. The platform does not prominently feature public audits or a detailed fee structure on its main site.

Website: https://yieldseeker.xyz

2. Coinbase — USDC Rewards

For those just beginning their journey into stablecoin income tools, Coinbase offers one of the most straightforward entry points. Its USDC Rewards program allows eligible U.S. users to earn a variable annual percentage yield (APY) simply by holding USDC on the platform. This completely removes the complexity of managing private keys, interacting with DeFi protocols, or navigating on-chain transactions. It's a "set it and forget it" solution for earning yield.

The primary advantage is its seamless integration with the traditional financial system. Users can easily purchase USDC with USD from a linked bank account and start earning rewards automatically once they hold at least $1. Payouts are distributed weekly, and the funds remain liquid, meaning there are no lockup periods. This low-friction experience is designed to build confidence for users new to the crypto space.

Key Features and Considerations

Coinbase’s offering stands out for its simplicity and security, but it's important to understand the trade-offs involved.

Best For: Beginners who prioritize ease of use and are not yet comfortable with self-custody or DeFi.

Risk Profile: Low. The primary risk is custodial; you are trusting Coinbase to secure your funds, not a smart contract. The reward rate is also variable and can change based on market conditions.

Access: The program is generally available to U.S. users, but eligibility can vary by state and account type. There are no fees to participate.

Pros:

Extremely user-friendly with an excellent fiat on-ramp.

No on-chain knowledge required; Coinbase handles all technical aspects.

Weekly payouts and no lockups provide high liquidity.

Cons:

Custodial risk means you don't control your own keys.

Lower APYs compared to on-chain DeFi opportunities.

Program availability and rates are subject to change by Coinbase.

For a deeper dive into how this and other platforms facilitate stablecoin yields, you can learn more about ways to earn interest on stablecoins.

Website: https://www.coinbase.com/usdc

3. Aave

For users ready to step into on-chain finance, Aave is one of the most established and trusted stablecoin income tools available. As a non-custodial DeFi lending protocol, it allows users to supply stablecoins like USDC or DAI to earn a variable interest rate paid by borrowers. Operating across multiple blockchains, including low-fee networks like Base, Aave provides direct exposure to on-chain lending markets without a centralized intermediary holding your funds.

The core advantage of Aave is its deep liquidity and battle-tested security. Users interact directly with smart contracts using their own self-custody wallet, giving them full control over their assets. The interest rates are determined transparently by supply and demand dynamics within each market. This model offers a pure DeFi experience for those comfortable managing their own keys and navigating on-chain transactions.

Key Features and Considerations

Aave stands out for its robust infrastructure and significant role in the DeFi ecosystem, but it requires a higher degree of user knowledge than centralized options.

Best For: DeFi users who want direct, on-chain exposure to lending markets and are comfortable with self-custody.

Risk Profile: Medium. The primary risks are smart contract vulnerabilities (though Aave is heavily audited) and market risk, where variable APYs can fluctuate significantly based on borrowing demand.

Access: Permissionless. Anyone with a self-custody wallet (like MetaMask) and some cryptocurrency for gas fees can access Aave's markets.

Pros:

Deep liquidity and a long-standing security track record in DeFi.

Full self-custody means you always control your private keys.

Broad asset and network coverage, including efficient chains like Base.

Cons:

Requires DeFi familiarity and use of a self-custody wallet.

Variable APYs can change quickly with market conditions.

Users must pay network gas fees for all transactions (deposits, withdrawals).

Website: https://www.aave.com/app

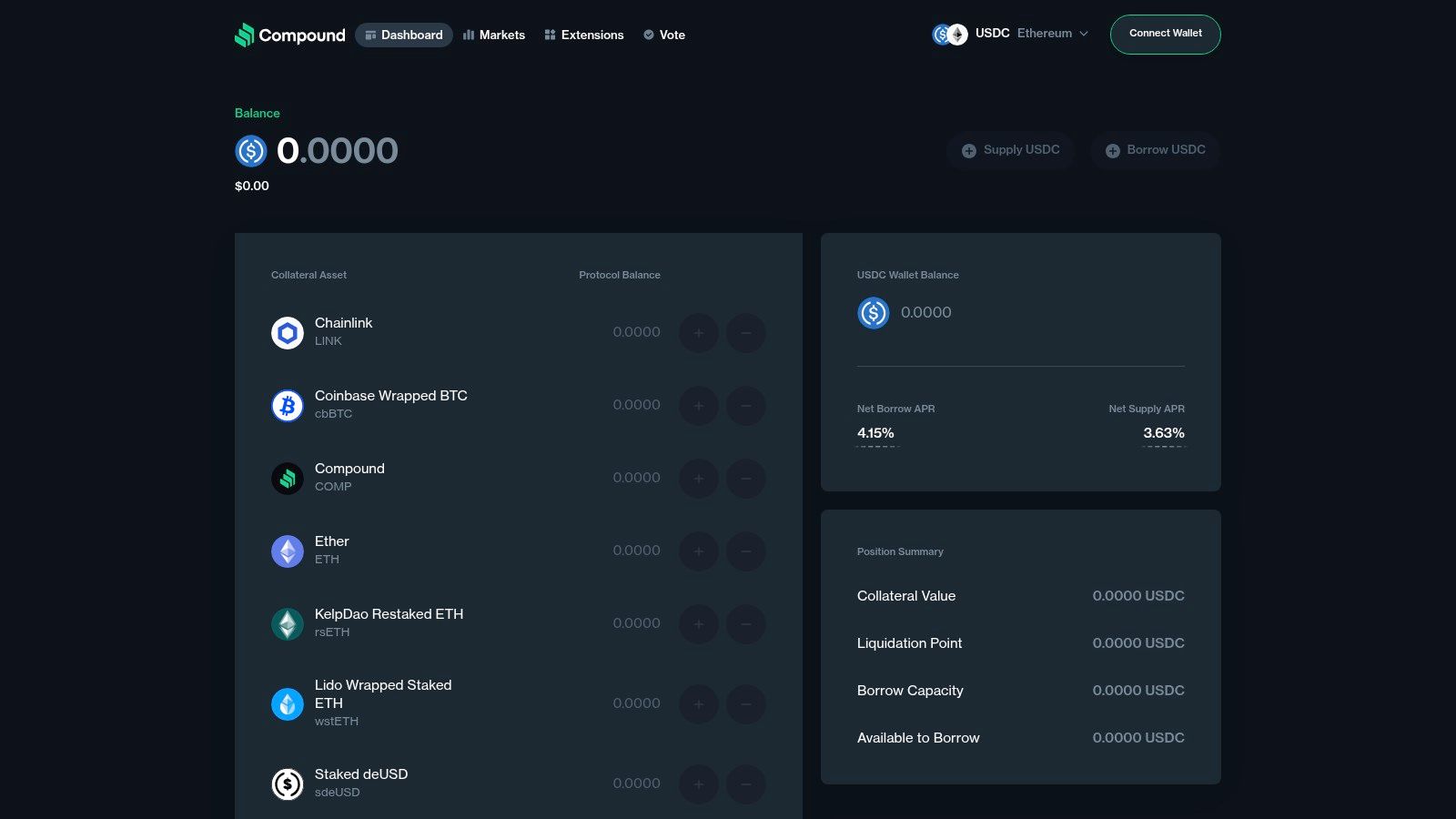

4. Compound (v3 / Comet markets)

Compound is one of the original blue-chip decentralized lending protocols, and its v3 "Comet" markets represent a significant evolution in its design. For users seeking stablecoin income tools, Compound offers a direct, on-chain way to earn yield by supplying assets like USDC into a lending pool. Borrowers then take loans from this pool, and the interest they pay is distributed to suppliers. This model provides a transparent and battle-tested method for generating returns directly from on-chain economic activity.

The key innovation of Compound v3 is its single-base-asset market design. Unlike earlier versions where any asset could be borrowed, each v3 market is built around a single borrowable asset, like USDC on Ethereum. This minimizes the risk of cascading liquidations and contagion from volatile collateral assets, making it a more secure environment for liquidity providers. It’s a foundational DeFi protocol that remains a core building block for many other yield-generating applications.

Key Features and Considerations

Compound’s reputation is built on security and decentralization, but using it requires a hands-on approach to DeFi.

Best For: DeFi users comfortable with self-custody who want to supply stablecoins directly to a foundational lending protocol.

Risk Profile: Medium. Risks include smart contract vulnerabilities (despite extensive audits), variable interest rates based on market demand, and the need to manage your own wallet and transactions.

Access: Permissionless and open to anyone with a compatible Web3 wallet. Users must pay gas fees for transactions like supplying and withdrawing funds.

Pros:

Proven lending model with a long track record and strong ecosystem integration.

Transparent and heavily audited smart contracts provide a high degree of security confidence.

Direct on-chain yield without intermediaries; you hold the cTokens representing your position.

Cons:

Variable APYs are entirely dependent on borrowing demand within the market.

Requires self-custody and a solid understanding of DeFi transactions and gas fees.

User interface is functional but less guided than centralized or aggregator platforms.

Website: https://app.compound.finance

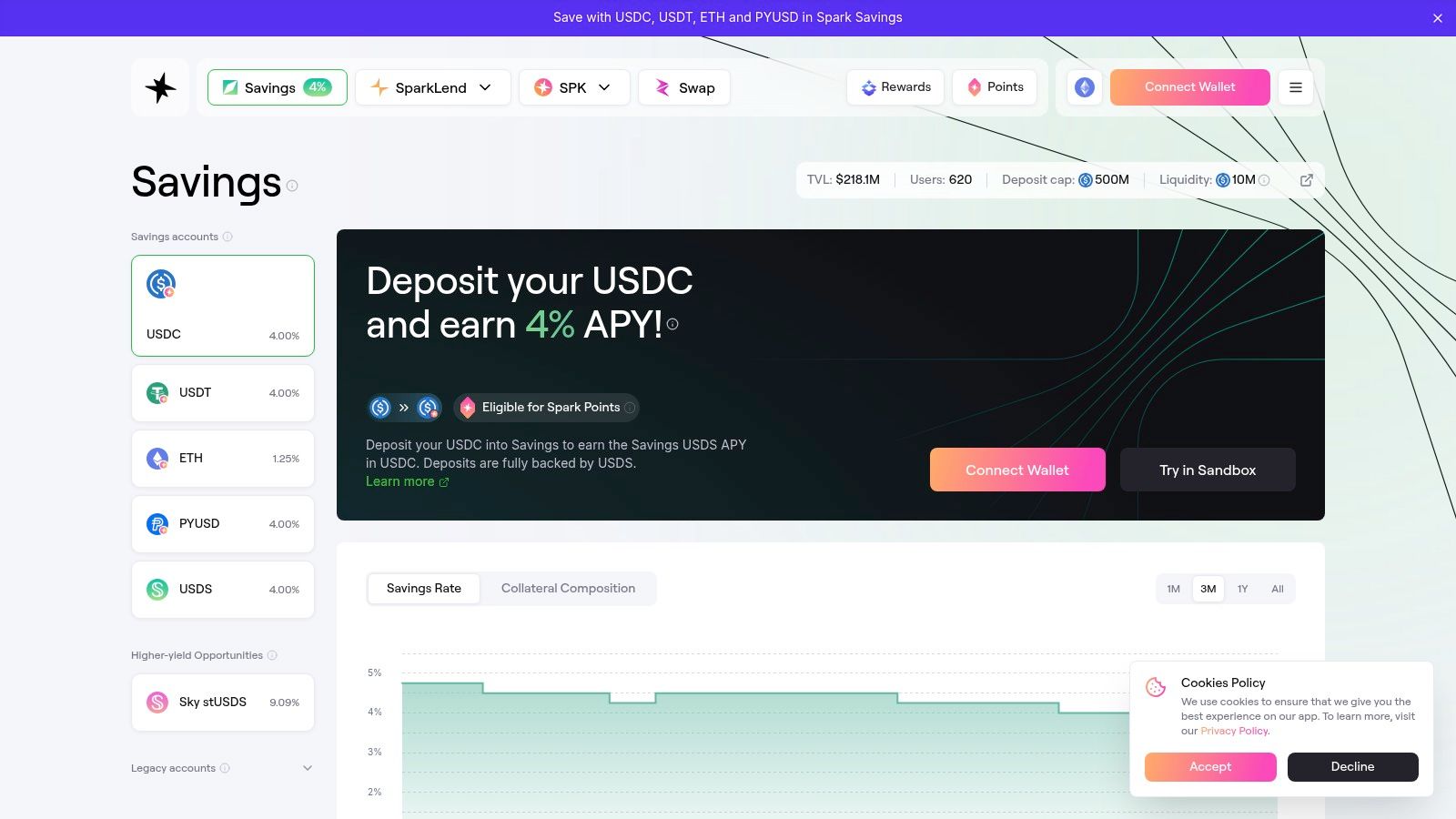

5. Spark by Sky (sUSDS / sUSDC savings vaults)

Spark by Sky provides a streamlined, on-chain savings experience for users looking for a "set and forget" approach to stablecoin yield. The platform features savings vaults where users can deposit USDC or the protocol’s native USDS stablecoin. In return, they receive ERC-4626 savings tokens (sUSDC or sUSDS) that automatically accrue yield based on the Sky Savings Rate (SSR). This design abstracts away the complexities of active yield farming into a simple deposit-and-hold mechanism.

The core value proposition is its direct link to the Sky Protocol's revenue streams, which fund the yield. By depositing USDC, users are essentially routing their funds through Sky's Peg Stability Module (PSM) to earn the SSR, which is managed by protocol governance. This makes it an appealing choice for those who want a transparent, on-chain savings account without needing to constantly manage positions across different DeFi protocols.

Key Features and Considerations

Spark's model is an evolution of simple staking, offering an interest-bearing token that represents your share of the savings pool and grows in value over time.

Best For: DeFi users who want a simple, on-chain savings solution backed by protocol revenue rather than lending markets.

Risk Profile: Medium. Risks include smart contract vulnerabilities and the variability of the Sky Savings Rate, which can be adjusted by governance. Users also need to be comfortable with on-chain transactions and gas fees.

Access: Permissionless access on supported chains like Ethereum and Base. Users need a compatible Web3 wallet and funds for gas fees.

Pros:

Simple, auto-accruing yield through ERC-4626 tokens.

Transparent yield source directly tied to Sky Protocol revenues.

On-chain and non-custodial for full user control over funds.

Cons:

Variable APY (the SSR) is subject to governance and can change significantly.

Requires on-chain interaction, including potential swaps and gas fees.

Newer protocol with less of a track record than more established platforms.

Website: https://app.spark.fi

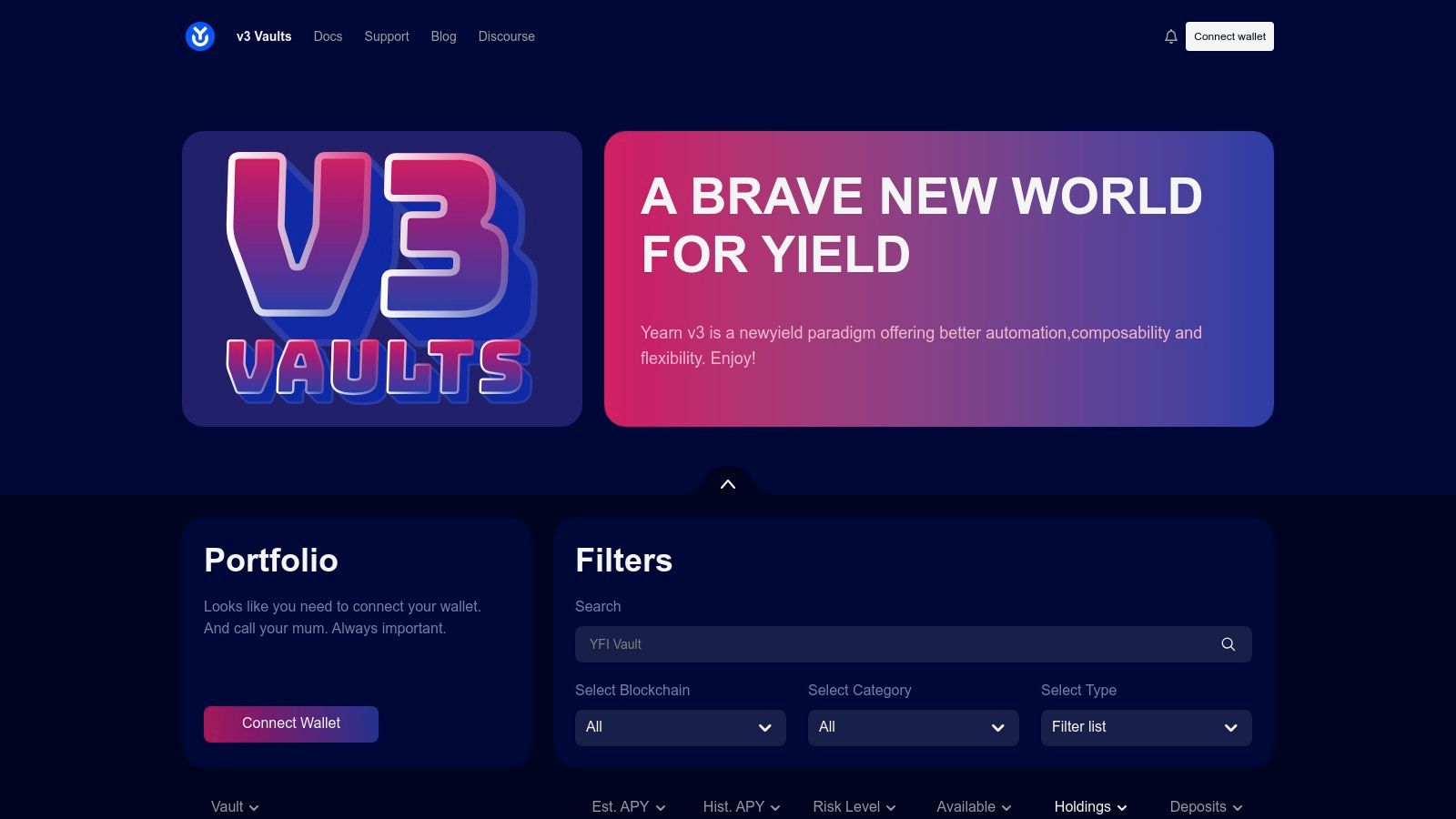

6. Yearn v3

Yearn v3 represents a cornerstone of decentralized finance, offering automated, multi-strategy vaults for users seeking optimized, on-chain stablecoin yields. It operates as a "set and forget" yield aggregator, allocating deposited stablecoins across a variety of vetted lending and liquidity-providing strategies to generate returns. This hands-off approach makes it an excellent stablecoin income tool for those who want exposure to complex DeFi strategies without needing to manage them actively.

The platform is designed for on-chain transparency. Users can deposit their stablecoins into specific vaults, and Yearn’s automated systems handle the rest, constantly seeking the best risk-adjusted yield. Its v3 architecture enhances this with improved composability and automation, appealing to both passive investors and developers building on top of its infrastructure. The clear presentation of APY, risk scores, and total value locked (TVL) provides users with the necessary data to make informed decisions.

Key Features and Considerations

Yearn excels at simplifying complex yield farming, but users must be aware of the inherent on-chain risks and associated costs.

Best For: Users comfortable with self-custody who want hands-off, automated yield optimization across multiple DeFi protocols.

Risk Profile: Medium. While strategies are vetted, users are exposed to smart contract risks of both Yearn and the underlying protocols it interacts with. Market volatility can also impact yields.

Access: Permissionless and available on multiple chains like Ethereum, Arbitrum, and Optimism. Users interact via a web3 wallet, and gas fees apply for transactions. Management and performance fees are typically charged on the generated yield.

Pros:

Automated strategy allocation saves users time and effort.

Transparent on-chain operations with clear risk scoring for vaults.

Broad multi-chain support allows users to access yield on different networks.

Cons:

Inherent smart contract risk from multiple integrated protocols.

Variable APYs that can fluctuate significantly with market conditions.

Gas costs on mainnet can be high, and performance/management fees reduce net returns.

Website: https://yearn.run

7. Beefy

For investors comfortable with DeFi, Beefy stands as a premier multichain yield optimizer. It automates the process of earning compound interest through its "vaults," which automatically harvest rewards from liquidity pools or single-asset strategies and reinvest them. This removes the need for users to manually claim and redeposit rewards, saving significant time and gas fees while maximizing returns through the power of compounding. It is one of the most established and widely used stablecoin income tools in the on-chain ecosystem.

The core value of Beefy lies in its "set and forget" auto-compounding vaults. A user can deposit a stablecoin or a stablecoin liquidity provider (LP) token into a vault, and the underlying smart contract handles all the complex harvesting and reinvesting operations. With a presence on over 30 blockchains, it offers an extensive catalog of strategies, allowing users to find stablecoin yield opportunities on both major and emerging networks.

Key Features and Considerations

Beefy's platform is designed for efficiency, but users must understand the inherent risks of interacting with various underlying DeFi protocols.

Best For: DeFi users who want to automate and optimize their yield farming strategies without constant manual intervention.

Risk Profile: Medium to High. The risk is layered; it includes the smart contract risk of both Beefy’s vaults and the underlying protocols they build upon. Each vault’s risk depends entirely on its specific strategy.

Access: Permissionless and available on dozens of blockchains. Users need a self-custody wallet like MetaMask and must pay gas fees for transactions.

Pros:

One-click auto-compounding saves time and drastically reduces gas costs.

Extensive multi-chain support provides a wide selection of strategies.

Transparent reporting on vault performance and strategies.

Cons:

Requires knowledge of DeFi concepts like gas, bridging, and smart contract risk.

Vault risk is inherited from the underlying protocols and can be complex to assess.

Gas and bridging steps are often necessary to access vaults on different chains.

Website: https://beefy.com

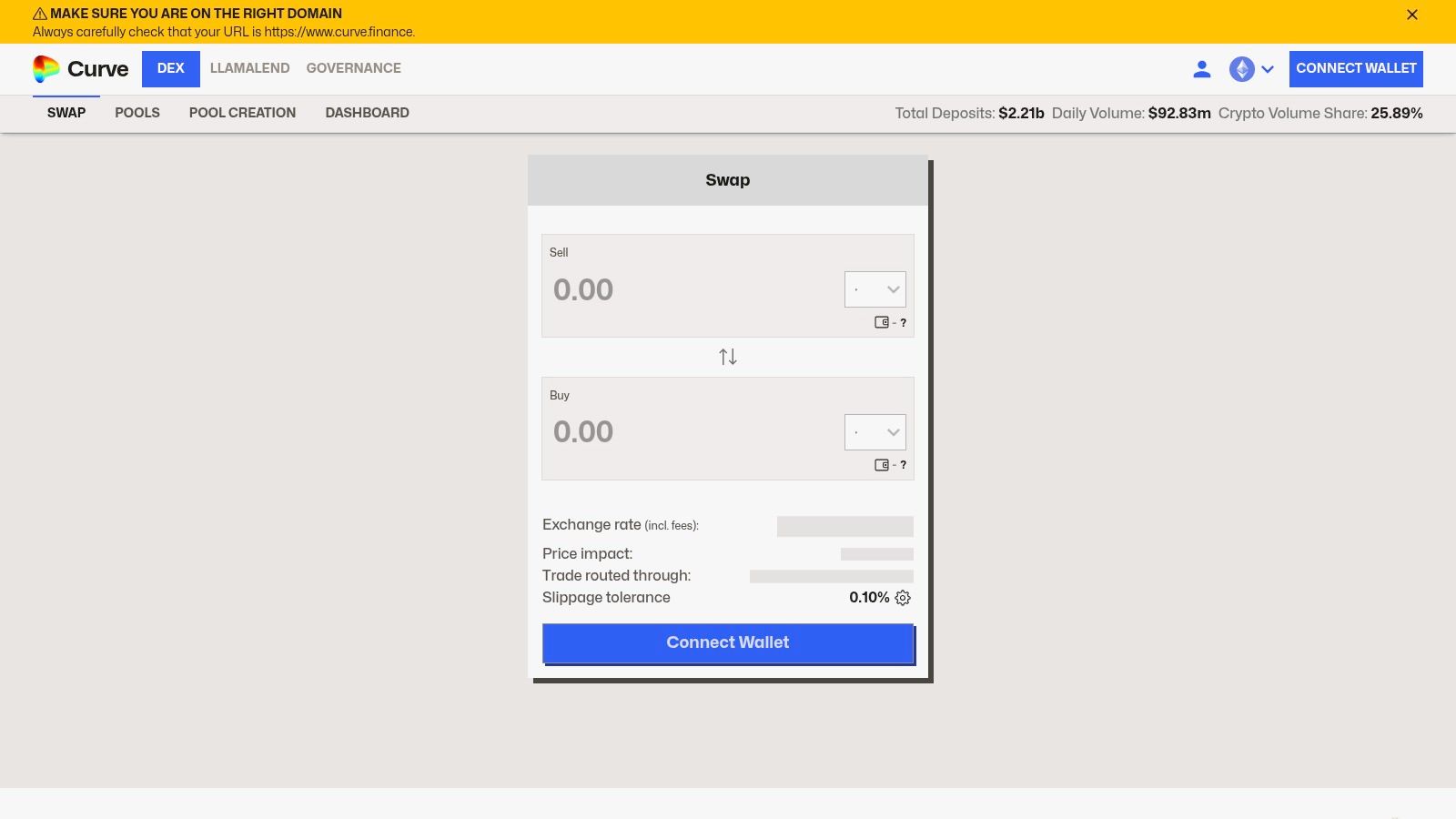

8. Curve Finance

Curve Finance is a cornerstone of the decentralized finance (DeFi) ecosystem, serving as a specialized automated market maker (AMM) focused on stablecoin swaps. Its unique algorithm is designed for extremely low slippage between assets pegged to the same value, like USDC and DAI. This makes it a foundational layer for many stablecoin income tools, where users can directly provide liquidity to its pools to earn trading fees and token incentives.

By depositing stablecoins into a Curve pool, users become liquidity providers (LPs) and receive a share of the fees generated whenever someone swaps tokens using that pool. This mechanism provides a direct, on-chain method for earning yield. Due to its deep liquidity and efficiency, Curve is heavily integrated with yield aggregators and optimizers, which build strategies on top of its pools to enhance returns for their users.

Key Features and Considerations

Curve is renowned for its capital efficiency and role as a DeFi primitive, but its interface and concepts can be challenging for newcomers.

Best For: Intermediate to advanced DeFi users who want to earn yield by providing liquidity and understand the associated risks.

Risk Profile: Medium. Risks include smart contract vulnerabilities, potential for a stablecoin to lose its peg within a pool, and impermanent loss (though minimized for stable-to-stable pairs).

Access: Permissionless and open to anyone with a Web3 wallet. Users must be cautious and use the correct official domain due to past DNS security incidents.

Pros:

Deep, time-tested stablecoin liquidity offering fee-based yield potential.

Low slippage for stablecoin swaps, making it a critical DeFi building block.

Broad integration across the DeFi ecosystem, enabling further yield opportunities.

Cons:

Power-user oriented UI that can be confusing for beginners.

LP risks including de-pegging events and variable incentive structures.

Requires active management and understanding of DeFi concepts to use effectively.

Website: https://www.curve.finance

9. Pendle Finance

For users seeking advanced stablecoin income tools, Pendle Finance introduces a sophisticated mechanism to tokenize and trade future yield. The protocol separates yield-bearing assets into two components: Principal Tokens (PT) and Yield Tokens (YT). This allows users to lock in fixed yields until maturity by purchasing PT, or speculate on future yield rates by trading YT. It essentially creates a yield-trading market for DeFi.

This unique approach empowers users with strategies unavailable on most platforms. For example, if you believe a protocol's floating APY will increase, you can buy its YT to capture that upside. Conversely, if you want to secure a predictable return and protect against falling rates, you can buy PT at a discount and redeem it for its full face value at maturity. Pendle transforms floating yields into marketable, fixed-rate instruments.

Key Features and Considerations

Pendle’s innovative model offers powerful capabilities but comes with a steeper learning curve compared to simpler yield platforms.

Best For: Advanced DeFi users who want to hedge, speculate on, or lock in future yield rates.

Risk Profile: High. Risks include smart contract vulnerabilities, market volatility for PT/YT, and potential impermanent loss if providing liquidity. The concepts are complex for beginners.

Access: Available on multiple chains including Ethereum and Arbitrum. Users need a self-custody wallet and must be comfortable with on-chain transactions and gas fees.

Pros:

Unique yield-trading market for advanced strategies.

Ability to lock in fixed rates that are otherwise variable in DeFi.

Multi-chain support with integrations across popular yield sources.

Cons:

Complex for beginners with a significant learning curve.

Market risks associated with the price volatility of PT and YT.

Gas costs and pool liquidity can impact strategy effectiveness.

These advanced methods are a core component of modern decentralized finance. To better understand the mechanics, you can explore more about stablecoin yield farming strategies.

Website: https://pendle.finance

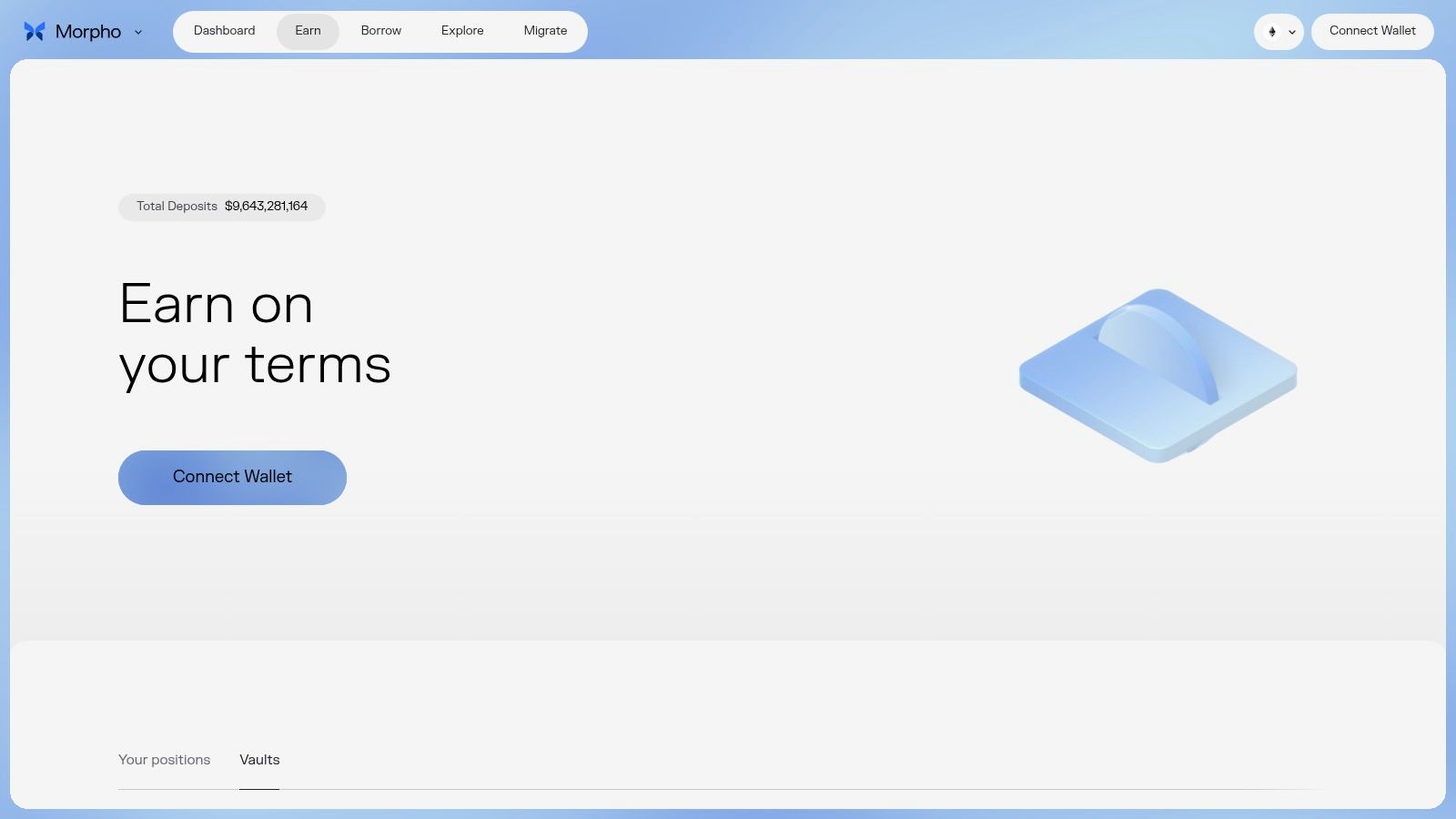

10. Morpho

Morpho introduces a performance-focused lending layer built on top of established protocols like Aave and Compound. It provides curated "MetaMorpho" vaults, allowing lenders to deposit stablecoins like USDC and earn yield from specialized, manager-built strategies. This model targets users who desire curated, performance-oriented lending exposure without having to manage individual positions across multiple protocols themselves. The platform's core innovation is its peer-to-peer matching engine, which improves capital efficiency and often results in better rates for both lenders and borrowers.

By depositing into a MetaMorpho vault, you delegate the asset allocation to a specific strategy manager who optimizes for risk and return. This makes it one of the more sophisticated stablecoin income tools, blending passive lending with active management. The platform provides detailed performance metrics and position health tracking directly within the app, offering transparency into how your capital is being utilized.

Key Features and Considerations

Morpho’s unique architecture offers a more efficient lending experience, but it requires a foundational understanding of DeFi concepts.

Best For: Intermediate to advanced DeFi users seeking optimized lending rates and exposure to curated, risk-managed strategies.

Risk Profile: Medium. Risks include smart contract vulnerabilities of both Morpho and the underlying protocols (Aave/Compound), as well as the strategy risk associated with the specific MetaMorpho vault manager.

Access: Permissionless and available on Ethereum and other EVM-compatible chains. Users need a self-custody wallet and ETH for gas fees to interact with the protocol.

Pros:

Improved capital efficiency often leads to higher yields compared to base lending protocols.

Curated vault architecture provides risk-segmented options with professional management.

High transparency with detailed analytics and documented on-chain fallbacks.

Cons:

Requires DeFi familiarity and comfort with on-chain transactions and gas fees.

Vault performance and risk vary significantly depending on the manager and strategy chosen.

Layered risk as it builds upon other lending protocols, inheriting their risks.

Website: https://app.morpho.org

11. Notional Finance

For investors seeking predictable returns, Notional Finance offers a sophisticated suite of fixed-rate, fixed-term stablecoin income tools. It allows users to lend stablecoins for a predetermined period and earn a locked-in yield, removing the uncertainty associated with the fluctuating rates common in DeFi. This makes it an ideal platform for those who want to forecast their earnings precisely and avoid market volatility.

Notional’s strength lies in its specialized focus on fixed-rate markets, which function similarly to zero-coupon bonds in traditional finance. With its v3 upgrade, the platform expanded its offerings to include variable-rate lending and leveraged yield strategies, catering to a wider range of risk appetites. This combination provides a powerful toolkit for users to express their views on interest rate movements while generating stablecoin income.

Key Features and Considerations

Notional stands out by bringing the predictability of traditional fixed-income products to the decentralized finance landscape.

Best For: DeFi users who want to lock in predictable yields for a set term and those with an opinion on future interest rate directions.

Risk Profile: Moderate. While yields are fixed, risks include smart contract vulnerabilities, potential illiquidity if exiting a position early, and the inherent complexities of DeFi protocols.

Access: Available on Arbitrum, requiring a self-custody wallet and ETH for gas fees. Users should be comfortable with on-chain transactions.

Pros:

Predictable income with fixed rates and clear maturity dates.

Transparent fee mechanics for entering and exiting positions.

Multiple strategy options, including fixed, variable, and leveraged yields.

Cons:

Early exits can incur fees and are dependent on market liquidity.

Requires DeFi experience and self-custody wallet management.

Gas costs on the underlying blockchain are a necessary expense.

Website: https://notional.finance

12. Franklin Templeton — Benji Investments

Bridging the gap between traditional finance and blockchain, Franklin Templeton introduces a novel option with its Benji Investments app. This platform offers access to the Franklin OnChain U.S. Government Money Fund (FOBXX), a regulated U.S. money market fund whose ownership is recorded on-chain via the BENJI token. This structure provides a cash-equivalent yield from traditional assets but with the transparency and potential of a tokenized system.

The core advantage is its foundation in the highly regulated world of traditional finance. Users gain exposure to yields generated by U.S. government securities, which is a fundamentally different risk profile from DeFi lending protocols. The Benji app facilitates onboarding and management, effectively tokenizing a traditional money market fund share. This makes it one of the most unique stablecoin income tools, appealing to those who prioritize regulatory clarity and real-world asset backing.

Key Features and Considerations

Benji Investments stands out by tokenizing shares of a ’40-Act registered fund, offering a compliance-first approach to on-chain yield.

Best For: Users seeking yields from traditional financial assets with the benefits of blockchain-based record-keeping and a low-risk profile.

Risk Profile: Very Low. The primary risk is market risk associated with the underlying U.S. government securities, not smart contract or protocol risk. The fund aims to maintain a stable $1.00 net asset value (NAV).

Access: Requires full KYC/AML through the Benji mobile app. The fund is subject to a fund expense ratio, and certain features like USDC conversions are being rolled out in phases.

Pros:

Regulated fund structure offers a high degree of investor protection and transparency.

Stable $1 NAV target backed by U.S. government money market instruments.

Bridges traditional cash management with on-chain token accessibility.

Cons:

Strict KYC/AML is required, limiting anonymity.

On-chain interoperability and features are still evolving.

Fund expense ratio applies, slightly reducing the net yield to the investor.

Website: https://www.franklintempleton.com/benji

Stablecoin Income Tools — 12-Platform Comparison

Product | ✨ Key features / USP | ★ Quality | 💰 Pricing / Value | 👥 Best for |

|---|---|---|---|---|

🏆 Yield Seeker | ✨ AI Agent for real‑time, risk‑aware USDC allocations; no lockups; built‑in terminal & walkthroughs | ★★★★☆ | 💰 $10 min; no withdrawal fees; fee details limited | 👥 Stablecoin holders, busy pros, DeFi beginners & treasuries |

Coinbase — USDC Rewards | ✨ Custodial rewards with fiat on/off and weekly payouts | ★★★☆☆ | 💰 Variable APY; custodial (no on‑chain management) | 👥 Fiat‑native beginners & U.S. users |

Aave | ✨ Multi‑network money markets; audited risk params & deep liquidity | ★★★★☆ | 💰 Variable APY; gas applies; no platform lockups | 👥 DeFi users seeking lending exposure |

Compound (v3 / Comet) | ✨ Minimal Comet markets for single‑base assets; transparent audits | ★★★★☆ | 💰 Variable APY; self‑custody & gas costs | 👥 DeFi users & integrators |

Spark by Sky (sUSDS/sUSDC) | ✨ ERC‑4626 vaults that auto‑accrue Sky Savings Rate (SSR) | ★★★★☆ | 💰 Variable SSR; swap/gas costs | 👥 On‑chain savers wanting simple auto‑accrual |

Yearn v3 | ✨ Automated multi‑strategy vaults with risk scores & UI signals | ★★★★☆ | 💰 Performance/management fees may apply | 👥 Hands‑off yield seekers & experienced users |

Beefy | ✨ Auto‑compounding vaults across 30+ chains; harvest automation | ★★★★☆ | 💰 Vault fees; gas/bridging may apply | 👥 Multi‑chain yield optimizers |

Curve Finance | ✨ Specialized stablecoin AMM with low slippage & deep liquidity | ★★★★☆ | 💰 Fee income for LPs; impermanent/peg risk | 👥 Advanced LPs & traders |

Pendle Finance | ✨ Tokenize future yield (PT/YT) to hedge or lock rates | ★★★☆☆ | 💰 Market‑driven pricing; gas & liquidity risk | 👥 Advanced traders & hedgers |

Morpho | ✨ Curated MetaMorpho vaults with manager performance metrics | ★★★★☆ | 💰 Strategy/vault dependent; gas costs | 👥 Curated lending seekers & DeFi natives |

Notional Finance | ✨ Fixed‑term, fixed‑rate markets for predictable income | ★★★★☆ | 💰 Fixed yields; early‑exit fees possible | 👥 Investors needing predictable, locked income |

Franklin Templeton — Benji | ✨ 40‑Act U.S. government money fund tokenized as BENJI | ★★★★☆ | 💰 Expense ratio; KYC & phased functionality | 👥 Regulated investors bridging TradFi → on‑chain |

Choosing Your Path to Stablecoin Income

The journey through the landscape of stablecoin income tools reveals a dynamic and evolving ecosystem. We've explored everything from the foundational pillars of DeFi lending like Aave and Compound to the sophisticated, set-and-forget automation of AI-driven platforms like Yield Seeker. What’s clear is that the one-size-fits-all approach to earning yield is a thing of the past. Your ideal tool is not necessarily the one with the highest advertised APY, but the one that aligns perfectly with your individual needs, risk tolerance, and desired level of hands-on management.

For newcomers or those prioritizing simplicity and security, custodial options like Coinbase’s USDC Rewards or tokenized money market funds from Franklin Templeton offer a straightforward, low-friction entry point. They remove the complexities of on-chain transactions, providing a familiar experience while still putting your stablecoins to work. These are the "on-ramps" to earning, demanding little more than a few clicks.

As you move deeper into the DeFi-native world, the choices expand. Yield aggregators such as Yearn and Beefy represent a significant leap in efficiency, automatically compounding your returns and hunting for the best rates across various protocols. They are the workhorses of passive income, saving you time and gas fees while optimizing your strategy. Similarly, peer-to-peer optimizers like Morpho present a compelling, capital-efficient alternative to traditional lending pools.

Key Takeaways for Your Strategy

As you formulate your plan, several core principles stand out. Diversification is not just a suggestion; it's a necessity. Spreading your capital across multiple stablecoin income tools, different protocols, and even different blockchains can mitigate platform-specific risks. Relying on a single source for yield, no matter how reputable, introduces a single point of failure.

Furthermore, understanding the risk spectrum is crucial. A simple USDC deposit on Coinbase carries a different risk profile than providing liquidity to a volatile pair on Curve or tokenizing future yield on Pendle. Always ask: Where does the yield come from? What are the smart contract risks? Is the protocol audited and time-tested? Your comfort level with these questions should guide your capital allocation.

Actionable Next Steps: Finding Your Fit

To put this knowledge into practice, start by defining your personal profile.

Assess Your Time Commitment: Are you a "set-and-forget" investor, or do you enjoy actively managing and rebalancing your positions? Your answer will point you toward either automated solutions like Yield Seeker and Yearn or more hands-on tools like Curve and Pendle.

Define Your Risk Tolerance: Be honest about how much risk you are willing to take. If capital preservation is your absolute priority, look to over-collateralized lending markets and established, blue-chip protocols. If you're comfortable with more complexity for potentially higher returns, advanced strategies might be suitable.

Start Small and Scale: Never go all-in on a new platform or strategy. Begin with a small, experimental amount of capital that you are comfortable losing. Observe the tool's performance, user experience, and fee structure before committing more significant funds.

The world of stablecoin income tools offers an unprecedented opportunity to turn static assets into a productive, cash-flowing portfolio. By thoughtfully selecting tools that match your goals and diligently managing your risks, you can build a resilient and intelligent income stream that works for you around the clock. The power is in your hands to navigate this exciting frontier and make your capital work smarter.

Ready to put your stablecoin strategy on autopilot? Yield Seeker leverages AI to automatically find and manage the best risk-adjusted yield opportunities, saving you time and maximizing returns without the manual effort. Explore how intelligent automation can transform your approach to earning with our advanced stablecoin income tools at Yield Seeker.