Think of it like a financial GPS for your crypto, one that’s constantly scanning thousands of roads to find the fastest and most profitable route for your money. That’s the big idea behind algorithmic yield routing—a system that automatically moves your capital across different DeFi protocols to squeeze out the best possible earnings while keeping an eye on risk.

It's built to solve a huge headache: trying to manually track all the different yield opportunities in a market that never sleeps.

The Next Evolution in DeFi Yield Generation

DeFi is full of incredible ways to earn passive income, but let's be honest, it’s a chaotic and fragmented world. Yields on lending platforms, liquidity pools, and staking protocols can change in the blink of an eye.

Trying to keep up with it all by yourself isn't just a full-time job—it’s pretty much impossible, even for the most dedicated investor. This is exactly the problem algorithmic yield routing was created to fix.

At its core, this tech acts like a smart, tireless financial manager for your digital assets. It automates the entire process of sniffing out and jumping on the best yield opportunities available at any given moment.

Moving Beyond Manual Strategies

Without a system like this, an investor is stuck doing everything the hard way:

Constantly refreshing dozens of different DeFi platforms.

Analyzing Annual Percentage Yields (APYs) that are all over the place.

Guessing what the gas fees will be for every single transaction.

Trying to figure out the smart contract risks for each protocol.

Manually executing a bunch of transactions just to move funds from one place to another.

This old-school approach is slow, clumsy, and often leads to emotional decisions. You're almost always too slow to catch those brief windows of super-high yield. Algorithmic routing throws all that guesswork out the window and replaces it with a data-driven system that works for you 24/7.

An algorithmic routing system doesn't just chase the highest APY. It intelligently balances yield, transaction costs, and protocol risk to find the optimal risk-adjusted return for your capital.

Why Automation Is Now Essential

The DeFi ecosystem has absolutely exploded, which just makes manual management even tougher. The total value locked (TVL) in DeFi shot past $190 billion in total deposits, a jump of nearly 260% from 2023. You can dig into these DeFi yield farming statistics to see the data for yourself.

This massive growth means more protocols, more complexity, and a lot more noise. An algorithmic system is designed to cut right through that noise, using sophisticated logic to make decisions that are both faster and way more informed than a human ever could be.

So, how does it all come together? The table below gives a simple breakdown of the core parts that make this technology work.

Core Components of Algorithmic Yield Routing

This table breaks down the essential functions of an algorithmic yield routing system, providing a high-level overview of how it operates.

Component | Function | Analogy |

|---|---|---|

Signal Generation | Scans and pulls in real-time data on yields, fees, and risks across the entire market. | A team of scouts reporting on traffic conditions across all available roads. |

Routing Engine | Analyzes all that data to figure out the most profitable and safest path for your money. | The central GPS computer calculating the single best route based on the scout data. |

Execution Layer | Automatically moves funds using smart contracts to execute the chosen strategy. | The self-driving car that follows the GPS instructions perfectly. |

Monitoring & Rebalancing | Continuously tracks performance and market changes to adjust the strategy on the fly. | The GPS rerouting in real-time if a faster road opens up or an accident happens. |

Each piece plays a critical role, working together to create a system that’s always looking for the best place for your assets to be. It’s a game-changer compared to setting and forgetting your funds in a single protocol.

How the Automation Engine Actually Works

Think of algorithmic yield routing like a high-tech, self-driving car built specifically for your capital. It doesn’t just blindly follow a pre-set map. Instead, it constantly scans its surroundings, crunches mountains of data, and makes smart decisions in real-time to get you to your destination—maximum yield—as safely and efficiently as possible.

This whole operation can be broken down into four automated steps that run in a continuous loop. Let's pop the hood and see how this engine turns raw market data into profitable moves.

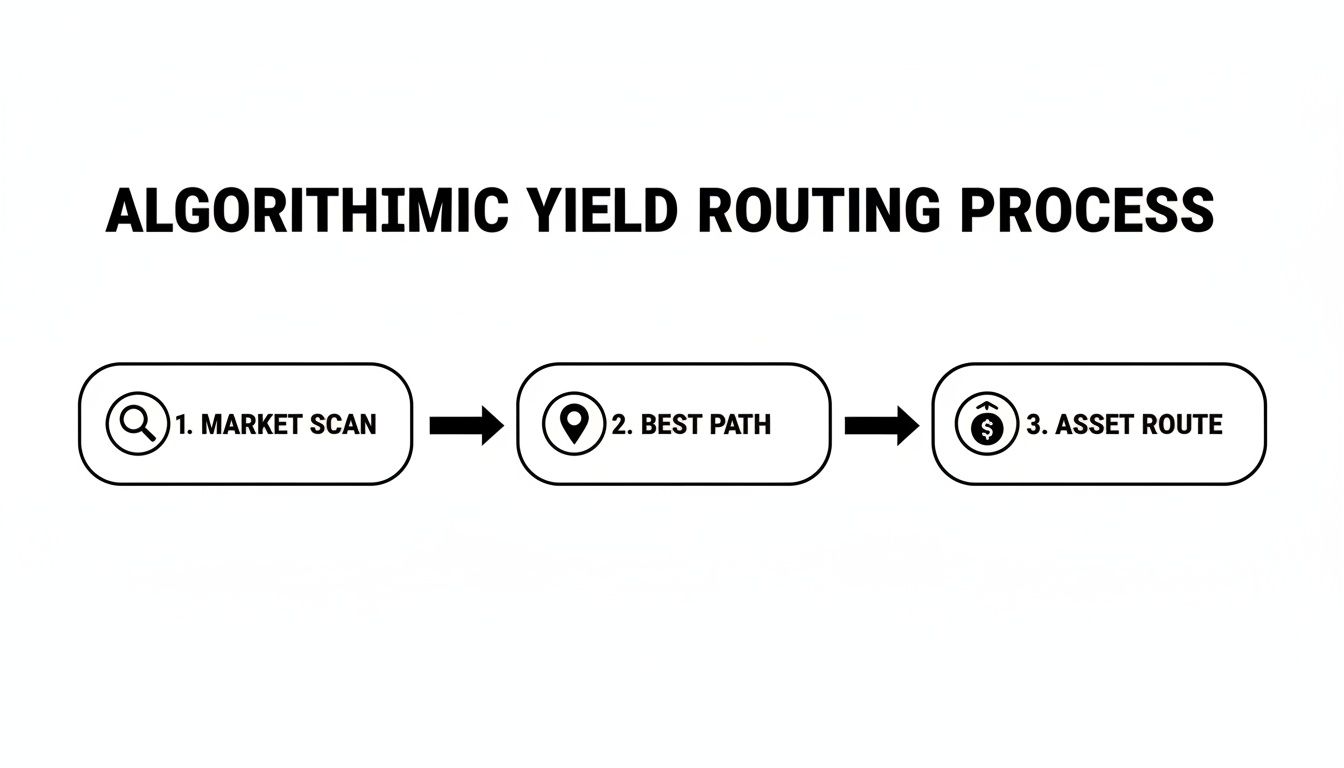

This flowchart gives you a bird's-eye view of the core process.

As you can see, it’s a clear progression: scan all the opportunities, figure out the single best path, and then execute the move. Simple in theory, but the magic is in the details.

Step 1: Data Aggregation and Signal Generation

Everything kicks off with a massive data collection effort. The system acts like a swarm of tiny sensors, constantly monitoring the entire DeFi ecosystem and pulling in thousands of data points every second.

This goes way beyond just looking for the highest Annual Percentage Yield (APY). The engine gathers a much wider range of critical information, including:

Yield Data: APYs from every lending protocol, liquidity pool, and staking opportunity it can find.

Transaction Costs: Real-time gas fees on the blockchain, which can easily eat into your net returns if you're not careful.

Protocol Risk: Key stats on a protocol's security history, smart contract audits, and total value locked (TVL).

Liquidity Metrics: How easily you can get in and out of a position without causing the price to slip.

All this data creates the foundation for every decision that follows, giving the system a crystal-clear, unbiased snapshot of the market at any given moment.

Step 2: The AI Routing Engine

Once the data is in, it’s fed into the "brain" of the operation: the AI-powered routing engine. This is where the system sifts through all that raw information to pinpoint the single best strategy available right now. It uses complex algorithms to weigh different factors against each other, modeling countless scenarios to predict their outcomes.

It's constantly asking questions like, "Is the high APY on Protocol X really worth the higher gas fees and potential smart contract risk? Or is the slightly lower but more secure yield on Protocol Y a smarter move?"

The routing engine essentially works like a super-powered GPS. It maps out all the possible routes for your capital and calculates the most efficient path based on a scoring system that balances reward, cost, and risk.

To access the widest range of opportunities, many routing engines rely on deep blockchain connections, especially through networks like Ethereum. You can learn more about how extensive Ethereum integrations are and the way they open up access to a huge variety of DeFi protocols.

Step 3: Smart Contract Execution

After the AI engine has locked onto the optimal route, the system has to act. This part is handled by the execution layer, which uses smart contracts to move funds automatically and securely.

This step is completely hands-off. No human needs to click "approve" or sign off on the strategy. The system executes the fund transfer with absolute precision, deploying the capital to the target protocol exactly as the routing engine instructed. This speed is a huge advantage, letting the system jump on fleeting opportunities that a person would almost certainly miss.

Step 4: Continuous Optimization and Rebalancing

The job isn’t done once the funds are deployed. Algorithmic yield routing is a dynamic, nonstop loop. The system is always monitoring the performance of its current position while, at the same time, scanning the market for something even better.

If market conditions shift—maybe a new protocol launches with a fantastic risk-adjusted yield, or gas fees suddenly plummet—the engine will spot it. It will then automatically kick off the entire cycle again, rebalancing the portfolio by moving the capital to the new, more profitable position. This 24/7 feedback loop ensures your assets are always in the best possible place to grow.

For anyone curious about the underlying tech, taking a look at how a yield optimization protocol is built provides a much deeper insight into these automated systems.

Balancing High Returns with Smart Risk Management

Chasing the highest possible Annual Percentage Yield (APY) is a tempting game in DeFi, but it's a dangerous one. Those flashy returns often hide serious risks that can wipe out your capital in a blink. This is why a real algorithmic yield routing system plays a much smarter game: it’s all about maximizing risk-adjusted returns, not just the raw yield.

Think of it like a pro race car driver versus an amateur. The amateur might just slam the gas pedal to the floor on every straightaway, but the pro knows winning is about balancing speed with control. They manage their tire wear, slow down for the turns, and focus on finishing the race—not just setting one crazy lap record. That’s the same disciplined approach an algorithm takes with your capital.

The goal isn't just to find the biggest number. It's to find the most sustainable and secure yield, striking a balance that puts capital preservation right alongside profit.

Core Optimization Objectives Beyond APY

A robust algorithmic system looks far beyond a protocol’s advertised APY. It juggles multiple variables to figure out a strategy's true net return. The most important objectives include:

Minimizing Transaction Costs: High gas fees can quietly eat away at your profits, especially if you're working with smaller amounts or using strategies that rebalance often. The routing engine models these costs to make sure a "profitable" move is actually profitable after all the fees are paid.

Maximizing Liquidity: The system sticks to protocols where you can get in and out quickly without causing a major price impact (slippage). Getting stuck in an illiquid position can turn a great opportunity into a liability, trapping your capital.

Optimizing for Net Yield: This is the bottom line. The final calculation takes the gross APY, subtracts all the estimated transaction fees, and accounts for potential slippage to land on a realistic net yield. This ensures every decision is based on what you actually earn, not just a headline number.

This multi-faceted approach means the algorithm moves capital with a complete financial picture, fully aware of the real-world costs and benefits.

Built-In Safeguards for Capital Preservation

In DeFi, trust is everything. A reliable algorithmic yield platform builds that trust through layers of automated security checks and risk controls that are baked into its DNA. These aren't optional add-ons; they're fundamental to the system's design, working 24/7 to protect your assets.

For anyone managing a treasury or just investing cautiously, understanding these protections is crucial. The history of DeFi is littered with cautionary tales. In fact, the sector saw over $59 billion lost to exploits between 2020 and 2024, with a shocking 90% of that damage tied to algorithmic stablecoin protocols. You can learn more about these DeFi exploit statistics and how they’ve shaped today’s security practices.

It’s precisely because of this history that modern systems are built with a defense-in-depth philosophy.

A core principle of modern algorithmic routing is to never concentrate capital in a single protocol or strategy. Diversification is not just a feature—it's an automated, foundational rule to prevent a single point of failure from impacting the entire portfolio.

Here are some key protective measures that are always running in the background:

Rigorous Smart Contract Vetting: The system will only route funds to protocols that have passed extensive, independent security audits. It also looks at factors like a contract's age, total value locked (TVL), and track record to gauge its reliability.

Automatic Diversification: By spreading capital across multiple, uncorrelated protocols, the algorithm naturally cushions against risk. If one protocol hits a snag, the impact on the overall portfolio is contained.

Dynamic Risk Controls: The system is constantly on the lookout for red flags—like a sudden drop in a protocol's liquidity, weird transaction patterns, or de-pegging events. If a risk threshold is crossed, it can automatically pull funds to preserve capital.

These built-in safeguards turn a simple yield aggregator into a smart risk manager. For a deeper look into this, check out our guide on the best practices for risk management in automated DeFi. It's this comprehensive approach that allows platforms like Yield Seeker to deliver competitive returns while making capital preservation the top priority.

Comparing Algorithmic Routing to Manual Yield Farming

Is it really better to automate, or should you just do it yourself? When it comes to DeFi, this question usually boils down to a classic trade-off: control versus efficiency. To get a real sense of what algorithmic yield routing brings to the table, let's put it head-to-head with the old-school, hands-on approach of manual yield farming.

Picture two different investors. The first is a DeFi die-hard who spends their weekends hunting for alpha, meticulously tracking yields across dozens of protocols. The second is a busy professional who uses an automated platform to put their capital to work while they focus on their day job. Both want the same thing—to earn solid returns—but their day-to-day experiences couldn't be more different.

The manual farmer is stuck in a constant cycle of research, execution, and monitoring. They're glued to dashboards, social media feeds, and analytics sites, always trying to spot the next big opportunity before it vanishes. Once they find something promising, they have to manually push through a series of transactions, crossing their fingers that high gas fees don't eat up all their potential profit. It's a massive time sink, and it’s often driven by emotion—like the fear of missing out (FOMO) on a temporary APY spike.

The automated investor, on the other hand, just deposits their funds and lets the system take over. The algorithm does all the heavy lifting, working 24/7 to scan the market, analyze opportunities, and rebalance capital on their behalf. It jumps on opportunities that might only last for a few minutes—windows that a manual farmer would almost certainly miss while sleeping or at work.

A Head-to-Head Comparison

The difference in approach really comes to life when you break it down side-by-side. While manual farming offers total control, it demands a steep price in time and effort. Algorithmic routing flips that script, trading a bit of that granular control for unparalleled efficiency and speed.

The table below lays out the core distinctions between these two strategies.

Factor | Manual Strategy | Algorithmic Routing |

|---|---|---|

Time Commitment | High; requires daily, sometimes hourly, monitoring of market trends. | Minimal; a "set and forget" approach where the system handles everything. |

Execution Speed | Slow; limited by human reaction time and manual transaction signing. | Instantaneous; smart contracts execute trades in seconds to grab fleeting APYs. |

Required Expertise | Significant; demands deep knowledge of DeFi, risk, and gas fees. | Low; designed to abstract away complexity for users of all skill levels. |

Emotional Bias | High; decisions can easily be swayed by FOMO, hype, or panic. | None; operates purely on data, logic, and pre-set risk parameters. |

Opportunity Scope | Limited to what one person can realistically track and manage. | Expansive; simultaneously analyzes hundreds of pools and protocols at once. |

This comparison shows it's not just about convenience. It’s about creating a more systematic, disciplined, and ultimately more effective way to engage with the market.

The Evolving Landscape of Yield

This contrast is more important than ever in today's market. The wild, unsustainable triple-digit APYs of the early days are mostly a thing of the past. Now, success comes from navigating complex, layered rewards.

The yield farming market has stabilized around a 7% to 12% APY band for major stablecoin strategies, moving away from unsustainable incentives. Success now depends on navigating complex, layered rewards like liquid restaking. Learn more about the current state of onchain yield and its implications.

This shift makes real-time analytics and automated capital allocation a necessity, not just a luxury. It’s the only way to reliably distinguish sustainable, fee-based revenue from temporary, high-risk promotions. An algorithm can parse these complex reward structures far more effectively than a human ever could, finding the true signal in the noise.

Ultimately, algorithmic routing isn't just about saving time; it's about making smarter, faster, and less emotional decisions in a market that never stops moving.

Putting Automated Yield to Work: Real-World Examples

The theory behind algorithmic yield routing is great, but its real power snaps into focus when you see it solving actual problems for real people. Whether you're an individual investor or a massive organization, these automated systems are unlocking efficiency and opening up opportunities that just weren't possible before.

Let's dive into a few concrete examples of this tech in the wild.

The big idea here is to get away from a "set it and forget it" strategy tied to a single protocol. Instead of parking your funds in one spot and hoping for the best, an algorithm is constantly on the job, shuffling capital around to capture the best possible risk-adjusted returns as the market shifts.

This dashboard from a platform like Yield Seeker shows you exactly what that looks like—a system allocating funds across several strategies at once to balance risk and crank up the earnings.

This isn't just about chasing the single "best" APY. It's about building a living, breathing portfolio of yield sources that all work in concert.

Hands-Off Income for Individuals

Picture Sarah, a busy professional with a good chunk of her portfolio in stablecoins like USDC. She wants to put that money to work earning a steady, low-risk return, but she doesn't have the time—or the deep DeFi expertise—to constantly track the market's every move.

Doing it manually would be a nightmare. She'd have to research dozens of lending protocols and liquidity pools, compare APYs that change by the minute, calculate gas fees for every potential move, and try to wrap her head around the smart contract risk for each platform. Honestly, it's a full-time job.

With an algorithmic yield router, Sarah just deposits her USDC into one simple interface. From there, the system’s engine takes the wheel. It automatically splits her funds across a pre-vetted, diversified set of high-quality protocols. Maybe it puts 40% into a stable lending market, 30% in a blue-chip liquidity pool, and the last 30% into another trusted protocol, constantly fine-tuning the mix as yields fluctuate.

The result? Sarah earns a competitive yield, completely hands-off. She never has to sign a single transaction to move her funds around. She gets all the upside of DeFi without any of the operational headaches.

Smart Treasury Management for DAOs

Now, let's scale up. Think of a DAO or a Web3 company sitting on a multi-million dollar treasury of stablecoins. This isn't just play money; it's operational capital for payroll, grants, and building new products. Leaving it idle in a wallet is a huge waste, but actively managing it is both risky and a massive time sink for the team.

For a DAO treasury, the game isn't about high-stakes speculation. It's about preserving capital while generating modest, sustainable growth. An algorithmic router is a perfect match for this goal, as it's built to prioritize risk-adjusted returns over chasing sky-high, volatile APYs.

An automated system is the ideal solution here. The DAO can deploy a slice of its treasury into a routing engine with custom risk parameters. The system gets to work, automatically diversifying those funds across low-risk, highly liquid strategies.

This approach keeps the treasury productive, generating a steady income that can help cover operational costs or fund the next big project. More importantly, the automation takes human error and emotional decision-making out of the equation when managing large sums of money, and built-in guardrails protect the organization's core capital.

Catching Fleeting Arbitrage Opportunities

At the highest level, routing engines can pull off incredibly complex strategies that a human could never execute manually. A perfect example of this is yield arbitrage.

Imagine two different lending protocols on the same blockchain. For just a few seconds, due to a market inefficiency, Protocol A is offering a 7.2% APY while Protocol B is offering 7.5%. This tiny 0.3% gap might only last for a minute or two before the market corrects itself.

A specialized algorithm can spot this fleeting difference in real-time. It instantly calculates the potential profit after factoring in gas fees and slippage. If the trade makes sense, it fires off a series of transactions—withdrawing from Protocol A and depositing into Protocol B—all within a single, atomic transaction.

This kind of high-frequency trading depends on the sub-second speed and precision that only an automated system can deliver. It’s a powerful showcase of how algorithmic yield routing can squeeze value out of market dynamics that are completely invisible to the human eye.

How to Get Started with an Automated Strategy

Ready to put your assets to work? Jumping into algorithmic yield routing isn't nearly as complicated as it sounds. The real trick is knowing what to look for, focusing on a few key things that separate the solid platforms from the sketchy ones.

Think of it like choosing the right car for a road trip. You wouldn't hop in without checking the brakes and making sure you're the one holding the keys, right? The same logic applies here.

First thing's first: make sure any platform you consider is non-custodial. This is a deal-breaker. It means you—and only you—have control over your funds. Your assets might be interacting with smart contracts, but you always hold the keys and can pull them out whenever you want.

Next, you need to see a real commitment to security. Talk is cheap, but independent proof is everything.

Core Features of a Trustworthy Platform

When you're kicking the tires on different options, keep an eye out for these fundamentals. They're the building blocks of trust and safety in DeFi.

Third-Party Security Audits: Reputable platforms don't just say they're secure; they prove it. They hire respected security firms to pick apart their smart contracts. These audit reports should be public and easy to find, giving you a transparent look at the code's integrity.

Clear Reporting and Dashboards: You should never be left guessing about your performance. A good platform gives you a clean, simple dashboard showing your balance, what you've earned, and exactly which strategies are being used. No mystery boxes.

No Lockups or Penalties: Real financial freedom is about having access to your money when you need it. Steer clear of any platform that locks up your funds or hits you with fees just for withdrawing your own assets.

These features make sure you’re always in the driver's seat, with total visibility over your strategy.

A core principle of a well-designed yield platform is radical transparency. You should be able to see exactly where your capital is allocated and how it's performing at all times, without navigating complex UIs or obscure transaction logs.

Finding the Right Fit for Your Goals

Once you've ticked the boxes for security and control, the last piece of the puzzle is finding a platform that you actually like using. A system is only as good as its user experience.

Look for a clean, straightforward interface that makes it dead simple to deposit funds and watch your earnings grow. The whole point is to make life easier, not more complicated.

Platforms like Yield Seeker, for instance, are built for both DeFi pros and people just starting out. The goal is to hide all the complexity under the hood, letting you focus on your financial goals instead of the technical nitty-gritty.

Getting started is really about picking a partner that puts your safety first and gives you clear, actionable information. To see how this all comes together, check out our full guide to automated crypto investing. If you stick to the principles of security, transparency, and user control, you can confidently step into a much smarter way of earning in DeFi.

Got Questions? We've Got Answers.

Jumping into any new tech, especially in finance, naturally brings up a few questions. Let's tackle the most common ones about algorithmic yield routing, giving you straight, clear answers on how it all works and what you can expect.

Is My Money Safe with Algorithmic Routing?

This is the big one, and the answer is yes. Your safety is priority number one. Reputable platforms are built on a non-custodial model. In simple terms, this means you always keep full ownership of your assets. A company never holds your funds; they're managed by audited, open-source smart contracts.

On top of that, the system automatically diversifies your capital, spreading it across multiple well-established, battle-tested protocols. This smart move prevents any single point of failure from threatening your whole portfolio, creating a much more resilient and secure setup for your money.

How Is This Different from a Robo-Advisor?

Good question. While they both automate investing, they're playing in completely different leagues. A traditional robo-advisor is stuck in the old financial system, making trades through brokers with delays and very little transparency.

Algorithmic yield routing, on the other hand, lives entirely on-chain. Every single transaction is public, verifiable on the blockchain, and happens almost instantly through smart contracts. It brings a level of speed and autonomy that traditional finance just can't touch.

It’s not just rebalancing a stock portfolio once a quarter. It's constantly shifting capital between decentralized protocols to grab the best yield opportunities the moment they appear, 24/7.

What Kind of Returns Should I Realistically Expect?

Let's be real: the wild, four-digit APYs from DeFi's early days are a thing of the past. Modern algorithmic routing is all about generating stable, risk-adjusted returns. The aim is to deliver a competitive and sustainable yield, not chase after speculative, high-risk gambles that could blow up.

Of course, performance will shift with the market, but the system is designed to do better than just holding your assets or letting them sit in one static protocol. It gets this done by intelligently hunting for opportunities while actively keeping an eye on downside risk, aiming for steady, consistent growth over the long haul.

Do I Ever Lose Control of My Crypto?

Never. This is a non-negotiable principle in DeFi and a core feature of any platform worth its salt. You deposit your assets into smart contracts that you, and only you, interact with directly from your own wallet.

You can withdraw your funds anytime you want. No asking for permission, no waiting through annoying lockup periods. You are always in control. The algorithm is just an automated agent working for you, but final ownership and access are always in your hands.

Ready to put your stablecoins to work with a smarter, automated strategy? Yield Seeker uses AI to find and manage the best risk-adjusted yield opportunities in DeFi for you.