If you've spent any time in DeFi, you know the drill with Ethereum: it's the main highway everyone wants to be on, but that means it’s almost always jammed. Transactions get expensive and slow. This is precisely the problem Base, a Layer 2 solution built by Coinbase, was designed to solve.

Think of Base as a brand-new express lane built right alongside that clogged Ethereum highway. It lets you zip past the traffic, paying way less in tolls (gas fees), but you still benefit from the security and final destination of the main road. That’s the magic of a Layer 2.

Base works by handling transactions "off-chain" before bundling them up and sending them back to Ethereum for final validation. This simple move slashes costs and speeds things up, making common DeFi activities like swapping tokens, lending, and providing liquidity way more efficient. If you want to get into the nitty-gritty, we cover the tech in our deep dive on Layer 2 scaling solutions.

The Coinbase Advantage

What really gives Base its horsepower is the deep connection to Coinbase, one of the biggest and most trusted names in crypto. This isn't just a branding exercise; it's a massive strategic edge that fuels its explosive growth.

Effortless Onboarding: Millions of Coinbase users can move funds directly onto Base in just a few clicks. This completely skips the confusing and often intimidating process of using a separate, third-party bridge.

Built-in Trust: Let's be honest, having a major, publicly-traded company behind a blockchain gives it a level of credibility that’s hard to ignore. It attracts everyone from first-time users to serious developers.

Massive User Base: If you're building a dApp, where do you want to build it? Probably where the users are. Developers on Base get a direct line to a potential audience of over 100 million verified Coinbase users.

Explosive Growth and Market Impact

This mix of low fees, high speed, and a frictionless user experience has been like rocket fuel for the Base DeFi scene. The most telling metric here is Total Value Locked (TVL)—basically, the total amount of money people have deposited into its protocols.

Base has seen mind-blowing growth, rocketing to a Total Value Locked (TVL) of $6.6 billion in deposits. This rapid climb has blown past established networks like Tron, landing Base in the fifth-largest spot among all blockchains for DeFi activity.

That $6.6 billion isn't just a vanity metric. It represents real people lending, borrowing, and trading on the network, all chasing a faster, cheaper DeFi experience. And as we're about to see, this boom is creating a ton of new opportunities for stablecoin holders to put their capital to work.

Getting To Know The Core Protocols On Base

Jumping into the Base DeFi ecosystem can feel a bit like walking into a massive, bustling city for the first time. There are all these different buildings, each with a unique purpose, but they all interconnect to keep the economy humming. To find your way around, you first need to understand the main types of protocols—the "financial Legos" that everything else is built on.

Instead of getting bogged down by a long list of project names, let's break it down by what they do. Each category solves a specific problem, from swapping currencies to managing complex loans. Once you grasp these core functions, you'll be able to navigate the landscape and put your crypto to work with confidence.

Decentralized Exchanges (DEXs)

Think of a Decentralized Exchange (DEX) as a 24/7 currency exchange booth that runs itself, with no cashier needed. It’s a platform where you can swap one crypto asset for another right from your own wallet, completely cutting out the need for a bank or a centralized company to process the trade.

These platforms are the absolute lifeblood of any DeFi ecosystem. They provide the liquidity that lets assets flow freely. DEXs run on smart contracts and are powered by everyday users who deposit their tokens into liquidity pools, earning fees for providing that service. That user-powered model is exactly what makes them "decentralized."

Two big players have really cemented themselves as the go-to DEXs on Base:

Aerodrome Finance: Often seen as the main liquidity hub on Base, Aerodrome has a clever model for rewarding liquidity providers, which has attracted deep liquidity for tons of different token pairs. It's not uncommon for its transaction volume to set new records on the network.

Uniswap: As one of the original and most trusted names in all of DeFi, Uniswap’s presence on Base offers a familiar and reliable place for swapping tokens with plenty of liquidity.

Lending and Borrowing Protocols

If DEXs are the currency exchanges, then lending protocols are the decentralized community banks. These are platforms where you can lend out your crypto to earn interest or borrow assets by putting up some collateral. It's a peer-to-peer system that gets rid of the traditional middleman.

This creates a much more efficient way to use capital within the Base ecosystem. Crypto that would otherwise just be sitting in a wallet can be put to work to generate a return. Borrowers, on the other hand, can get access to cash without selling their holdings, which opens the door to more advanced financial strategies.

On Base, the lending market is a cornerstone of its activity. Protocols in this category allow for a fluid movement of capital, enabling users to earn passive income on their holdings or leverage their assets for new opportunities, all governed by transparent, automated rules.

A couple of key players you'll run into are:

Aave: A top-tier liquidity protocol that’s a household name across multiple chains. Aave’s version on Base provides a secure and very deep market for lending and borrowing a wide range of assets.

Morpho: Morpho is cool because it acts like an optimization layer that sits on top of protocols like Aave. It matches lenders and borrowers more efficiently to squeeze out better interest rates for everyone involved.

To give you a clearer picture, here’s how these fundamental protocol types stack up.

Key DeFi Protocol Categories on Base

Protocol Category | Core Function | Top Examples on Base |

|---|---|---|

Decentralized Exchanges (DEXs) | Enables peer-to-peer swapping of digital assets without a central intermediary. | |

Lending & Borrowing | Allows users to lend assets to earn interest or borrow against collateral. | Aave, Morpho |

Stablecoin Vaults / Yield Aggregators | Automates yield-farming strategies for stablecoins to maximize returns for depositors. | Platforms that automatically deploy capital into lending and liquidity strategies. |

Liquid Staking Protocols | Lets users stake assets (like ETH) while receiving a tradable token (LST) in return. | Protocols that issue LSTs like cbETH, allowing staked assets to remain liquid. |

This table covers the foundational layers of the Base ecosystem. By combining these different "Lego blocks," you can build all sorts of interesting financial strategies.

Stablecoin Vaults And Yield Aggregators

Stablecoin vaults are basically smart savings accounts built to squeeze every last drop of return out of your dollar-pegged assets, like USDC. You deposit your stablecoins, and the protocol automatically puts them to work in different yield-generating strategies across the ecosystem.

These platforms, also known as yield aggregators, do all the heavy lifting. They’re constantly hunting for the best returns from lending on Aave, providing liquidity on Aerodrome, or whatever other strategy is paying well at the moment. This saves you the headache of manually moving your funds around, making them a great starting point for anyone looking for passive income without wanting to become a full-time DeFi trader.

For example, a vault might automatically lend your USDC on Aave when rates are high, then shift it over to a liquidity pool on Aerodrome if that becomes more profitable. It’s this active management that helps them generate really competitive yields.

Liquid Staking Protocols

Normally, when you "stake" an asset like ETH to help secure the network, your funds are locked up and you can't touch them. Liquid Staking Protocols came up with a brilliant fix for this: they give you a "receipt" token in exchange for your staked asset.

This receipt, called a Liquid Staking Token (LST), represents your share of the staked pool but is completely free to be traded and used elsewhere in DeFi. You can use it as collateral for a loan, add it to a liquidity pool on a DEX, or just sell it—all while your original ETH is still earning those staking rewards in the background. This simple idea has unlocked a massive amount of capital, making the whole ecosystem run more smoothly.

Popular Yield Strategies For Stablecoin Holders On Base

Knowing the key protocols on Base is one thing, but actually putting your capital to work is a whole different ball game. If you're holding stablecoins like USDC, your main goal is usually pretty simple: generate a steady, low-risk return on your dollars. The good news is that Base has a few clear paths to get you there, each with its own trade-offs.

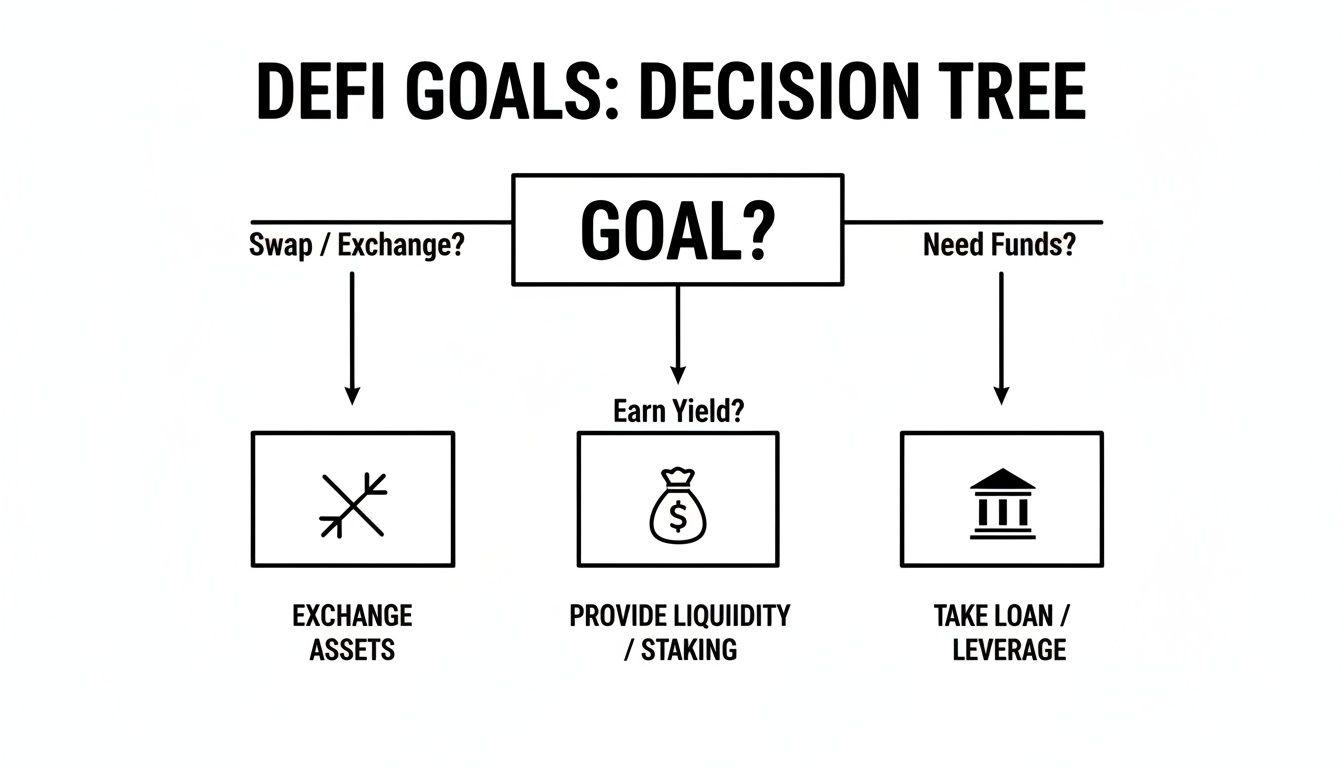

This decision tree gives you a bird's-eye view of your options in the Base DeFi world, from basic swaps to more complex ways to earn.

As you can see, the "Earn" path is where things get interesting for stablecoin holders, splitting into lending, providing liquidity, and other strategies.

Lending Your Stablecoins For Passive Interest

The most direct and generally safest route is simple lending. Think of it like a decentralized savings account. You deposit your USDC into a lending protocol like Aave or Morpho, and other users borrow it, paying interest for the privilege.

You pocket a share of that interest, paid out as a variable Annual Percentage Yield (APY). It’s a popular first step because your money isn't directly exposed to the wild price swings of other crypto assets.

Potential Rewards: You can earn a variable APY that often blows traditional savings accounts out of the water. These rates shift based on how much USDC is available versus how much is being borrowed.

Key Risks: The big one here is smart contract risk. This is the chance that a bug or an exploit in the protocol's code could lead to lost funds. Your best defense is sticking with battle-tested, well-audited platforms like Aave.

Providing Liquidity To Decentralized Exchanges

If you're willing to take on a little more complexity for potentially higher returns, providing liquidity to a DEX like Aerodrome or Uniswap is your next stop. Here, you deposit your stablecoins into a "liquidity pool," usually paired with another token (like a USDC-ETH pool). In return, you get a cut of the trading fees every single time someone swaps between those two assets.

This is a vital service for the DeFi ecosystem on Base, making sure there's enough cash sloshing around for trades to execute smoothly. We actually took a deeper look at this in our guide on stablecoin yield farming.

When you become a liquidity provider (LP), you're basically acting as a market maker. You aren't just holding an asset; you're actively helping the market function, and you get paid for it.

But this strategy comes with a unique risk that you don't face as a lender.

Understanding Impermanent Loss

When you supply liquidity to a pair of assets, you have to get familiar with a concept called impermanent loss. It's a weird name, but the idea is simple: it's the potential loss you face when the price of the tokens in the pool changes after you've deposited them. If one token's price shoots up or tanks, the total value of your position in the pool could end up being less than if you'd just held the two assets in your wallet.

Potential Rewards: The APY from trading fees can be much higher than lending, especially if you're in a pool that sees a lot of trading action.

Key Risks: On top of smart contract risk, impermanent loss is the major thing to watch out for. For pools with only stablecoins (like USDC-DAI), this risk is practically nonexistent. But when you pair a stablecoin with a volatile asset like ETH, the risk gets real, fast.

Ultimately, the right strategy boils down to your personal risk tolerance. Lending is a simple, set-it-and-forget-it path. Providing liquidity opens the door to better returns but demands you keep an eye on impermanent loss. It's this constant need for research and active management that makes automated solutions so appealing—they can handle the heavy lifting of finding and capturing yield without you having to watch the markets 24/7.

Getting Started On The Base DeFi Ecosystem Step-By-Step

Jumping into the Base DeFi ecosystem is a lot more straightforward than you might think. With the right tools and a clear roadmap, you can go from being a curious observer to an active yield-seeker in just a few moves. I'll walk you through setting up your wallet, getting funds onto the network, and doing it all securely.

Step 1: Choose And Set Up Your Wallet

Your wallet is your passport to everything on Base. It’s where you’ll keep your crypto and sign transactions to interact with DeFi protocols. For the smoothest ride, you’ll want a wallet that's built to work well with Base.

Here are the top choices:

Coinbase Wallet: Since Base was built by Coinbase, this wallet offers a nearly perfect integration. You can send funds from your main Coinbase account straight to your wallet on Base, making it the fastest and simplest option if you're just starting out.

MetaMask: This is the Swiss Army knife of crypto wallets, used by almost everyone across DeFi. If you’re already active on other chains, chances are you have it. You just need to add the Base network, which literally takes less than a minute.

No matter what you pick, write down your seed phrase, store it somewhere safe offline, and never, ever share it with anyone. That's the master key to your funds.

Step 2: Bridge Your Assets To Base

Okay, wallet's ready. Now you need to get some money onto the Base network. This is called bridging.

Think of it like wiring money from your main bank account (like Ethereum or your Coinbase account) to a high-yield savings account on a separate financial network (which is Base). You're just moving the same asset, like USDC, from one blockchain to another.

The official Base Bridge is a secure and direct way to do this.

The interface is clean and simple. You just pick the asset you want to move, punch in the amount, and start the deposit from Ethereum over to Base.

Here are your main options for getting funds across:

Directly from a Coinbase Account: By far the easiest way. Inside your Coinbase account, you can send assets right to your wallet address, just making sure you select the Base network.

The Official Base Bridge: This is the go-to for moving assets like ETH or USDC from the Ethereum mainnet. It’s reliable and backed by the core team.

Third-Party Bridges: Platforms like Stargate or Synapse also support Base. Sometimes they can be faster or cheaper for certain tokens, but they introduce another layer of smart contracts.

If you're new to this, stick with a direct transfer from Coinbase or use the official bridge. It’s the safest bet.

Step 3: Secure ETH For Gas Fees

Every single thing you do on Base—from swapping a token to depositing into a lending pool—requires a tiny fee to pay for the network's processing power. This is called a gas fee, and it’s always paid in ETH.

You really don't need much ETH on Base. Thanks to its Layer 2 design, transaction costs are incredibly low, often just a few cents. Having $5-$10 worth of ETH in your wallet is usually more than enough to cover dozens of transactions.

You can get this ETH by bridging a small amount over from Ethereum along with your stablecoins. Or, once your stablecoins arrive on Base, you can use a DEX to swap a few dollars' worth for ETH.

Step 4: Prioritize Security From Day One

As you start exploring all the opportunities in Base DeFi, security has to be your number one priority. This space is full of potential, but you need to protect yourself from the obvious risks.

Make these security practices second nature:

Bookmark Official Sites: Always navigate to DeFi apps using your own bookmarks. This is the simplest way to dodge phishing sites that look identical to the real thing.

Verify Contract Addresses: Before you interact with a new protocol or token, double-check its contract address on a block explorer like Basescan.

Use a Hardware Wallet: If you're moving any serious amount of money, connect a hardware wallet (like a Ledger or Trezor) to your MetaMask. This keeps your private keys completely offline, adding a massive layer of protection.

Revoke Permissions: Every time you use a new app, you grant it permission to access your funds. Get in the habit of using a tool like Revoke.cash to review and cancel old, unnecessary permissions.

Follow these steps, and you’ll be set up to explore Base safely and confidently.

Automating Your Yield With AI On Base

Trying to manage your own yield strategies in Base DeFi can feel like taking on a second job. Seriously. It takes constant research, a pretty deep grasp of some complex protocols, and hours spent watching for shifts in risk and opportunity. For most people, whether you're a busy professional or just getting your feet wet in DeFi, this hands-on grind is a huge turn-off. It often means leaving perfectly good returns on the table.

This is exactly where automation steps in and changes the game.

Instead of spending your evenings staring at dashboards and trying to make sense of fluctuating APYs, you can hand off the heavy lifting to an intelligent system built to do it for you. The whole point is to take a complicated, active process and flip it into a simple, passive income stream.

The Power of an AI-Powered Agent

Imagine you had a personal analyst working for you 24/7, whose only mission was to scan the entire Base ecosystem for the best risk-adjusted yield for your USDC. That’s the basic idea behind an AI-driven platform like Yield Seeker. It uses a sophisticated AI agent that continuously monitors, analyzes, and acts on market data in real-time.

But this isn't just about blindly chasing the highest APY. A genuinely smart system is weighing a whole mix of factors:

Yield Potential: Pinpointing which protocols are offering genuinely competitive returns.

Risk Assessment: Looking under the hood at smart contract security, how deep the liquidity is, and the protocol's overall reputation.

Efficiency: Factoring in transaction costs to see how they'll eat into your real returns.

By crunching thousands of data points, an AI agent can spot allocation opportunities a human investor would likely miss, getting your capital working harder without you needing to be constantly at the wheel. If you're curious about the mechanics, our article on the role of an AI yield aggregator breaks down the tech.

Effortless and Accessible DeFi

The real win here is how simple and accessible this makes things. Platforms like Yield Seeker are designed to smooth out all the friction, opening up sophisticated DeFi strategies to just about anyone. You can deposit as little as $10 in USDC and let the AI take over, automatically putting those funds into carefully vetted, yield-generating positions.

With Yield Seeker, the entire process is streamlined. There are no lockups, so your funds remain liquid and accessible whenever you need them. A transparent UI shows your balance and earnings at a glance, transforming the complex world of yield farming into a hands-off experience.

This kind of model absolutely thrives on Base's hyper-efficient setup. The ecosystem's DeFi scene is exploding thanks to ultra-low transaction costs and massive user engagement, with over 68.5 million active addresses and DeFi TVL pushing $1 billion. Since the Ethereum Dencun upgrade, transaction fees have plunged to less than 1 cent, which makes it possible for an AI to rebalance even small deposits without gas fees wiping out all the profits.

This approach effectively turns your idle stablecoins into a productive asset that works for you around the clock. For a bigger-picture look at applying AI to financial strategies, this practical guide to implementing AI in business offers a great high-level framework. By combining the intelligence of AI with the efficiency of Base, generating real passive income becomes a much more achievable goal for a lot more people.

Got Questions?

Diving into a new DeFi ecosystem like Base always brings up a few questions, especially when you're just starting out. Let's tackle some of the most common ones head-on so you can get started with confidence.

What Makes Base Different From Other Layer 2s?

Lots of Layer 2s like Arbitrum or Optimism use similar tech to help Ethereum scale, but Base has a killer feature that sets it apart: its deep, native connection to Coinbase.

Think about it. Coinbase is one of the biggest and most trusted names in crypto. This integration gives Base a massive, built-in audience and a ridiculously simple on-ramp. Millions of users can slide funds directly from their Coinbase account onto Base without messing with a third-party bridge.

This direct pipeline of users and fresh liquidity is the single biggest reason for its explosive growth and why so much is happening on the network.

Is The Base Ecosystem Safe To Use?

At its core, Base is built on top of Ethereum, meaning it gets its security from one of the most battle-tested and decentralized blockchains out there. That's a rock-solid foundation.

However, just like with any DeFi playground, the real risk isn't the network itself—it's the individual apps (or dApps) you choose to interact with. Your safety really depends on the quality of the smart contracts you're using. A bug or an exploit in a protocol's code is where things can go wrong.

Here are a few simple rules I always follow to stay safe:

Stick to the big names: Prioritize platforms that have been around the block, like Aave, Uniswap, and Aerodrome. They've been audited and have stood the test of time.

Verify everything: Seriously, double-check contract addresses and bookmark official websites. Phishing scams are everywhere.

Get a hardware wallet: If you're moving any amount of money you'd be sad to lose, a hardware wallet is a no-brainer. It keeps your private keys completely offline.

Do I Need A Lot Of Money To Start?

Not at all. This is one of the best things about Base. The low cost of entry is a huge draw.

Gas fees are incredibly cheap—we're talking a few cents for most transactions. This means you don't need a huge bankroll to get in the game. You can swap some tokens on a DEX for a few bucks, start lending a small amount of USDC on a platform like Aave, or even test out automated strategies.

For example, a platform like Yield Seeker is designed to be accessible, letting you get started with as little as $10 USDC. It's the perfect environment to learn the ropes without putting much on the line.

The whole point of Base is to make on-chain finance accessible for everyone. Low fees mean that even small-time players can tap into yield strategies that would be totally unaffordable on Ethereum mainnet.

What Is The Difference Between Lending and Liquidity Providing?

Great question. Both are popular ways to earn yield, but they work very differently and have completely different risk profiles. Getting this right is key.

Lending is pretty straightforward. Think of it like a decentralized savings account. You deposit your stablecoins (like USDC) into a protocol, and others borrow that capital, paying you interest for the privilege. Your return is that interest, and your main risk is basically just the smart contract of the lending platform itself.

Liquidity Providing (LPing) is a different beast. Here, you deposit your assets into a pool on a DEX to help other people trade. In return, you get a cut of the trading fees. While the potential returns can be higher, you're exposed to a unique risk called impermanent loss. This happens when the prices of the assets in your pool change relative to each other.

For a pool with two stablecoins (say, USDC-DAI), this risk is tiny. But if you're pairing a stablecoin with something volatile (like USDC-ETH), that risk becomes very real, very fast.

How Can An AI Platform Help Me On Base?

This is where things get really interesting. An AI-powered platform completely changes the game by automating all the tedious, complex parts of chasing yield. Instead of spending hours researching protocols, comparing APYs, and manually moving your funds around, an AI agent just does it for you.

Take Yield Seeker, for instance. Its AI is constantly scanning the entire Base ecosystem DeFi landscape. It hunts for the best risk-adjusted yield opportunities across dozens of protocols, looking at everything from liquidity and contract reputation to real-time interest rates. Then, it automatically puts your USDC to work to capture those yields.

This gives you a few massive advantages:

You save a ton of time: No more late nights staring at dashboards.

Your returns are optimized: The AI can spot and react to market shifts way faster than a human ever could, moving your capital to where it can earn the most.

Risk is managed for you: By spreading your funds across multiple vetted protocols, you're not putting all your eggs in one basket.

It takes a complicated, hands-on process and turns it into something simple and passive. It's the easiest way to make your stablecoins work for you.

Ready to put your stablecoins to work on Base without the manual effort? Yield Seeker uses an AI agent to automatically find and manage the best yield opportunities for you. Start earning smarter, passive income with as little as $10 USDC. Explore automated yield on Yield Seeker today.