Picture this: instead of dumping all your savings into one bank account, you have a personal financial assistant who's constantly moving your money between different banks, always hunting down the best interest rates while keeping your funds safe. That's the big idea behind multi-protocol allocation in the world of DeFi. It's a strategy that spreads your capital across multiple decentralized finance platforms to crank up your yield and build a much more resilient portfolio.

Unlocking a More Resilient DeFi Strategy

Back in the early days of DeFi, the playbook was simple. Find a protocol that looked promising, deposit your stablecoins, and hope the yield held up. It was straightforward, sure, but it was also like putting all your eggs in one basket.

If that single protocol got hacked, ran into liquidity problems, or its yields suddenly tanked, your entire stack was at risk. In today's fast-moving DeFi world, concentrating all your capital in one place is a massive vulnerability.

And let's be honest, the DeFi ecosystem is huge now. It's not just a couple of lending markets anymore. We're talking about a vast landscape of opportunities, each with its own unique blend of risk and reward. Sticking to just one spot means you're almost certainly missing out on better, more stable returns somewhere else.

The Shift to Smarter Diversification

This is where multi-protocol allocation changes the game. Instead of you having to manually research every new protocol and shuttle funds around, this approach uses automated systems to intelligently spread your capital. Think of it as having a sophisticated portfolio manager working for your stablecoins 24/7.

This strategy isn't just about spreading risk around—it's about actively sniffing out and grabbing the best risk-adjusted opportunities across the entire DeFi landscape in real-time. It turns passive holding into an active, dynamic game managed by smart automation.

By allocating funds across a mix of different protocol types, this method creates a far more robust and adaptable portfolio. If you want to go deeper on why this matters so much, check out our guide on the benefits of protocol diversification. The goal is to shift from a static, fragile position to a dynamic one that can actually thrive when the market gets choppy.

A solid multi-protocol strategy pulls from several key areas:

Lending Markets: These are the bread-and-butter platforms like Aave or Compound, where you can lend out stablecoins for a variable interest rate.

Liquidity Pools: Think of venues like Uniswap or Curve, where you provide liquidity for traders and earn a slice of the trading fees.

Yield Aggregators: These are protocols that automatically search for and farm the best yields from various sources, saving you the legwork.

Structured Products: These are more complex instruments that offer unique risk-and-return profiles, often combining different DeFi primitives.

A smart multi-protocol strategy doesn't just pick one; it strategically blends them. By doing this, it builds a balanced portfolio designed for sustainable growth, paving the way for a safer and more profitable journey in decentralized finance. Honestly, for anyone serious about generating consistent yield today, this approach is becoming non-negotiable.

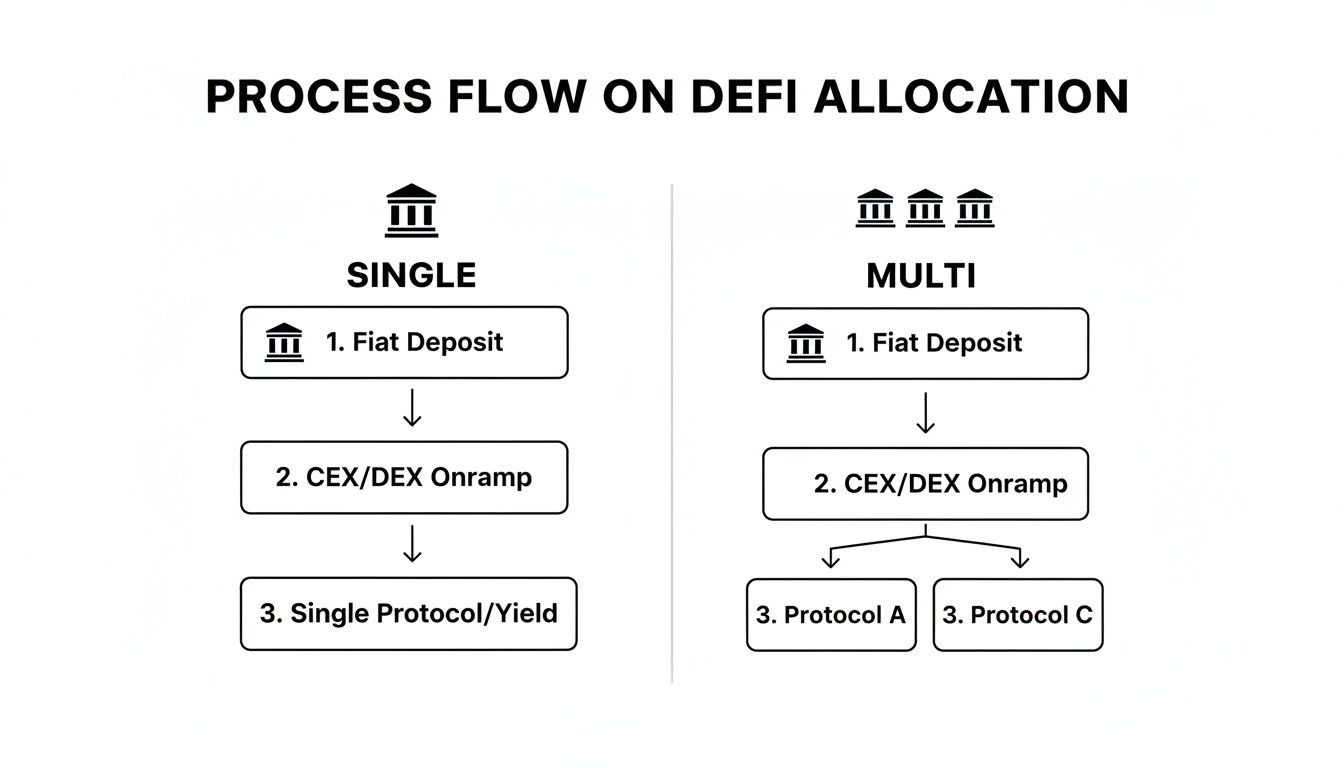

Single Protocol vs Multi-Protocol Allocation at a Glance

To make the difference crystal clear, let's break down how the old-school, single-protocol approach stacks up against a modern, multi-protocol strategy.

Factor | Traditional Single-Protocol Strategy | Automated Multi-Protocol Allocation |

|---|---|---|

Risk Exposure | High. All capital is exposed to a single point of failure (e.g., hack, exploit). | Lower. Risk is spread across multiple, diverse protocols, minimizing single-point failure. |

Yield Potential | Limited. Capped by the performance of one protocol; misses better opportunities. | Optimized. Actively seeks the best risk-adjusted yields across the entire DeFi market. |

Adaptability | Low. Static position that can't react to market changes without manual intervention. | High. Dynamically rebalances capital to adapt to changing yields and risk levels. |

Management Effort | High. Requires constant manual research, monitoring, and moving of funds. | Low. Automated systems handle allocation, rebalancing, and execution for you. |

As you can see, moving to a multi-protocol allocation is less of a minor tweak and more of a fundamental upgrade to how you approach DeFi yield. It's about working smarter, not harder, and building a foundation that's designed to last.

How Smart Money Moves Across DeFi

To really get what multi-protocol allocation is all about, you have to look under the hood. How does an automated system figure out the best place for your stablecoins? It's not magic. It's a disciplined, data-driven process powered by sharp algorithms, relentless monitoring, and the time-tested wisdom of diversification.

Think of it like having a team of hyper-efficient financial analysts working for you 24/7. These algorithms don't just blindly chase the highest Annual Percentage Yield (APY). They conduct a multi-factor analysis, scoring different opportunities based on a mix of critical metrics to find the sweet spot: the best risk-adjusted returns.

The Role of Allocation Algorithms

The allocation algorithm is the brains of the whole operation. It’s the set of rules that constantly scans the massive DeFi landscape, hunting for the most optimal places to park your capital. This isn't a one-and-done deal; it's an always-on process that judges protocols based on a few key pillars.

Typically, these pillars include:

Yield Potential: The raw, advertised return from a lending market or liquidity pool.

Liquidity Depth: How much money is in the pool. Can you move capital in and out easily without causing a price shock?

Risk Scores: A hard look at a protocol’s security. This means checking smart contract audits, its track record, and the reputation of the team behind it.

The algorithm then weighs these factors to pinpoint opportunities that deliver solid returns without putting your capital in unnecessary danger. This is a world away from just sorting a list by the highest APY. To see how these systems actually route funds, check out our deep dive on algorithmic yield routing.

This diagram nails the difference between just parking your funds in one spot versus dynamically spreading them across many.

As you can see, the multi-protocol approach creates a much more resilient and opportunistic flow for your capital, breaking free from the static, set-and-forget limitations of a single-venue strategy.

Diversification and Automated Rebalancing

Once the algorithms find promising spots, the system doesn't just dump everything into the #1 option. That would be reckless. Instead, it practices strategic diversification by spreading the funds across several different protocols. It’s the classic "don't put all your eggs in one basket" advice, but executed with robotic precision.

If one protocol has a bad day—maybe the yield dips or a security concern pops up—only a small piece of your total portfolio is exposed. This built-in resilience is a cornerstone of smart DeFi risk management.

But diversification is just one part of the puzzle. The real power move is automated rebalancing.

Automated rebalancing is the system’s ability to act like a tireless portfolio manager, constantly shifting funds in real-time as market conditions change. It moves capital from an underperforming pool to a newly profitable one, all executed securely and instantly by smart contracts.

Picture this: a liquidity pool on Uniswap sees its yield drop because trading has slowed down. At the same time, a lending market on Aave jacks up its interest rates because of high borrowing demand. The rebalancing mechanism spots this shift and automatically moves a chunk of capital from Uniswap over to Aave to capture that better return. This all happens in the background, with zero manual effort.

On-Chain Execution and the Modern DeFi Landscape

Every single one of these decisions—from the algorithmic analysis to the final rebalancing act—is ultimately executed on-chain through smart contracts. These self-executing bits of code are the engine that turns strategy into action, keeping the whole process transparent, secure, and decentralized. The people building this stuff, like a Senior DeFi Engineer specializing in on-chain data, are at the forefront of this financial evolution.

And the landscape they're working in is massive. In Q1 2023, the DeFi market had a Total Value Locked (TVL) of around $83.3 billion. Within that, decentralized exchanges held about $19 billion, while liquid staking protocols—a pretty new category—were already managing over $16 billion.

For an automated allocator, this means a smart strategy can easily span 5–15 different protocols at once, jumping between DEXs, lending markets, and liquid staking, often across multiple blockchains. This incredible diversity of opportunity is exactly what makes intelligent, multi-protocol allocation so powerful.

The Benefits and Realities of Dynamic Allocation

Putting your money to work with a dynamic, multi-protocol strategy is a powerful way to generate stablecoin yield, but it's not magic. It's crucial to understand the whole picture. This approach is the polar opposite of passively parking your funds in one place; it's about actively hunting for opportunities and managing risk in real-time.

By spreading capital across a hand-picked selection of DeFi protocols, you're building a far more resilient and efficient portfolio.

The biggest draw, of course, is the enhanced yield potential. The DeFi market never sleeps. Yields on lending platforms and in liquidity pools can swing wildly from one minute to the next. An automated system is built to catch those fleeting moments—like a temporary spike in trading fees on a DEX—that a human investor would almost certainly miss. This agility means it’s always working to find the best possible risk-adjusted returns across the entire market.

But it’s not just about chasing bigger numbers. This method is fundamentally about smarter risk management. Putting your entire stablecoin stack into a single protocol is a high-stakes bet. One bug, one exploit, or one black swan event could wipe you out. A multi-protocol allocation strategy is designed to prevent that, ensuring no single point of failure can torpedo your portfolio.

Capturing Value in a Fragmented Market

Today's DeFi ecosystem is incredibly diverse. In just five years, it's exploded from a handful of experiments into a complex landscape where capital is fragmented across dozens of competing venues.

By late 2024, the Total Value Locked (TVL) had roared back to $257 billion—a massive 129% jump from earlier lows. That liquidity is now spread thin across DEXs, lending markets, and various yield optimizers. This fragmentation is exactly what makes an automated strategy so effective. It thrives by exploiting the small yield differences across this vast space. You can get more insights on this from the 2024-2025 DeFi report.

Let's walk through a real-world example:

An automated agent has 30% of your capital in a lending protocol, earning a steady 6% APY.

All of a sudden, a different liquidity pool sees a massive spike in trading volume, temporarily boosting its fee-based APY to 11%.

The system’s algorithm spots this, checks the protocol’s risk score, and decides the opportunity is worth grabbing.

It automatically shifts a chunk of your funds from the lending protocol over to the high-yield pool. Once that yield cools down, it can move the capital back or onto the next best thing.

This constant shuffling ensures your capital is always working as hard as it can—a feat that's practically impossible to replicate manually with the same speed and precision.

Understanding the Trade-Offs

While the upside is clear, you have to go in with your eyes wide open about the realities and trade-offs. No strategy is risk-free, and anyone who tells you otherwise is selling something.

A core principle of multi-protocol allocation is acknowledging that while diversification reduces the impact of a single protocol's failure, it also broadens the surface area of potential risks. Prudent strategy is about managing this trade-off, not ignoring it.

Here’s what you need to keep in mind:

Compounded Smart Contract Risk: It’s simple math—the more protocols you interact with, the more smart contracts you’re exposed to. Each new protocol brings its own unique code and potential bugs. This is precisely why a non-negotiable part of any good strategy is rigorous, continuous security vetting for every single integrated protocol.

Gas Fees and Rebalancing Costs: Every on-chain move, especially rebalancing between protocols, costs gas. If a strategy is too twitchy, constantly shifting funds for tiny yield gains, transaction fees can quickly chew through your profits. A smart algorithm knows when to sit tight and only makes a move when the expected gain is well worth the cost.

Systemic and Cross-Chain Risks: DeFi is a deeply interconnected web. A major blow-up in a foundational protocol or a cross-chain bridge can send shockwaves everywhere. A truly comprehensive risk model has to look beyond individual protocols and account for these bigger, systemic dependencies that could hit the entire portfolio at once.

From Theory to Your Wallet: Automated Allocation in Action

It's one thing to talk about algorithms and risk models, but it's another thing entirely to see a multi-protocol allocation strategy actually come to life. The whole point of modern DeFi platforms is to wrap up this incredibly complex process into something that's not just powerful, but also dead simple for you to use.

This is exactly where tools like Yield Seeker come in. They take a sophisticated financial strategy and turn it into an accessible tool. The entire experience is designed to be frictionless, getting you from a simple deposit to active, automated yield generation without the usual DeFi headaches.

The User Journey, Simplified

It all starts with a single action: depositing stablecoins. The moment your USDC lands in the account, a personalized AI Agent springs into action. Think of it as your own dedicated, 24/7 portfolio manager that immediately puts your capital to work.

There's no need to spend your nights researching dozens of protocols, trying to compare constantly changing APYs, or fumbling through complex transactions on different platforms. The AI does all the heavy lifting, driven by one core goal: find the most competitive, risk-aware yields across the entire DeFi ecosystem, in real-time.

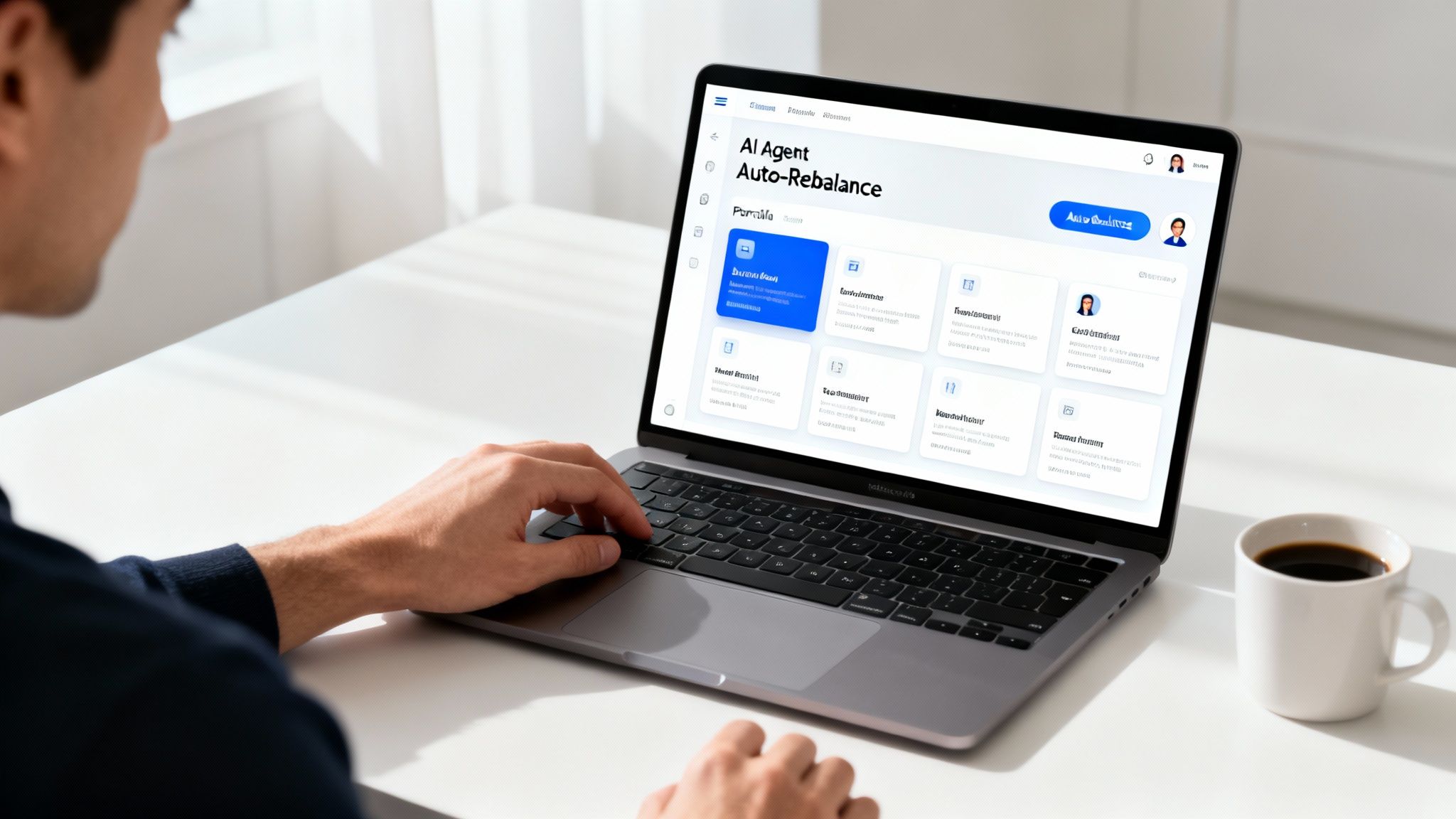

This is what it looks like in practice. The Yield Seeker dashboard gives you a clear view of your strategy's performance.

The real magic here is the mix of simplicity and depth. You can see top-level numbers like your balance and earnings at a glance, but you can also dig into the underlying strategies if you're curious.

What's Under the Hood of the AI Agent?

This AI Agent isn't just a basic bot. It’s a purpose-built system designed to constantly perform three critical jobs:

Market Analysis: It continuously scans a wide array of vetted DeFi protocols. It’s crunching data points like current yield, liquidity depth, gas fees, and protocol-specific risk scores to build a complete, real-time map of the opportunity landscape.

Optimal Allocation: Based on its analysis, the agent figures out the best way to allocate your capital. It’s not just chasing the highest APY; it’s building a diversified portfolio that balances high returns with solid risk management, spreading your funds to avoid any single point of failure.

Automated Execution: Once it has a plan, the agent executes all the on-chain transactions. It moves funds between protocols, harvests rewards, and rebalances the portfolio as market conditions change—all without you having to lift a finger.

The core idea is to turn a high-effort, expert-level task into something completely passive and automated. You bring the capital; the AI brings the constant vigilance, analysis, and execution needed to navigate DeFi markets effectively.

Keeping it Accessible and In Your Control

Making a powerful strategy like multi-protocol allocation truly accessible means tearing down the usual barriers. One of the biggest fears in DeFi is having your funds locked up. A user-first platform respects the spirit of DeFi by ensuring your capital stays liquid and available whenever you need it.

Unlike many yield strategies that demand long-term commitments, this approach means no lockups and no withdrawal fees. That flexibility is absolutely crucial. It puts you in complete control, letting you move funds in and out of your strategy as your own financial needs change.

This commitment to accessibility also shows up in the user interface. A clean, intuitive dashboard acts as a clear window into your portfolio's performance. You can track your earnings, see your current allocations, and get insights into the strategies your agent is deploying. This transparency builds confidence and demystifies the whole process, making it approachable even if you’re not a DeFi degen.

Ultimately, it’s about bridging the gap between the complex mechanics of automated finance and the simple desire to make your assets work harder for you.

Navigating Security in a Multi-Protocol World

When your capital is spread across a dozen different DeFi protocols, security isn't just a feature—it's the absolute bedrock of the entire strategy. Sure, a multi-protocol allocation approach opens up a world of opportunity, but it also dramatically broadens your exposure to risk. Handling this complexity safely demands a multi-layered security framework that’s both constantly watchful and ready to act.

Think of it like being the general manager for a sports team. You wouldn't just sign any player who showed up. You'd scout them, review their game tapes, and run a full medical check-up. That same level of rigorous vetting has to apply to every single DeFi protocol before a single dollar gets deployed.

The First Line of Defense: Protocol Vetting

Before a protocol is even considered for an allocation, it must pass a comprehensive security audit. And this isn't about just ticking a box; it's about digging deep into the smart contract code to hunt down any potential vulnerabilities. But let's be clear: audits are just the starting point.

A protocol's track record is just as critical. A platform that's been running for years without a major incident has proven a level of resilience that a brand-new protocol simply hasn't. This is the "Lindy effect" in action—the idea that the longer something has survived, the longer it's likely to keep surviving. It's a surprisingly powerful principle in DeFi security.

Finally, you have to scrutinize the integrity of cross-chain bridges. These bridges, which let assets hop between different blockchains, have historically been prime targets for massive exploits. A solid security model will only integrate with bridges that have iron-clad security measures and deep, substantial liquidity. You can learn more about how platforms tackle this in our detailed guide on smart contract risk scoring.

Automated Safeguards and Continuous Monitoring

In the fast-and-furious world of DeFi, a one-time security check is nowhere near enough. The entire environment can shift in an instant. This is why advanced platforms rely on automated systems for continuous threat detection. These systems act like a digital immune response, constantly scanning on-chain activity for the slightest sign of trouble.

This constant monitoring is what separates a passive, set-it-and-forget-it strategy from a truly managed one. It's the difference between just locking your front door and having a full-time security team watching every camera, ready to spring into action at the first sign of a threat.

And it’s not just about looking for known exploits. These systems are trained to spot weird anomalies that could signal a completely new or emerging threat.

Key things to watch for include:

Unusual Transaction Volumes: A sudden, massive withdrawal from a protocol can be a huge red flag for an active exploit or a classic bank run.

Governance Attacks: Monitoring for malicious proposals that could be used to sneakily drain a protocol's treasury.

Smart Contract Changes: Keeping an eye out for any unauthorized or suspicious updates to a protocol’s core code.

If any of these tripwires are hit, an automated safeguard can be triggered instantly. This "circuit breaker" can immediately withdraw all funds from the compromised protocol, whisking the capital away to a secure holding position. This kind of rapid-response capability is absolutely crucial for minimizing losses in a crisis that can unfold in minutes.

While no system can ever eliminate risk entirely, this combination of tough initial vetting and relentless automated monitoring provides the strongest possible defense for assets out in the wild world of multi-protocol DeFi.

How to Measure Success and Define Your Strategy

In DeFi, true success isn’t just about chasing the highest advertised APY. If you want to build a portfolio that lasts, you need a solid framework for judging performance and a clear strategy that actually fits your financial goals. It's about looking past the shiny numbers and focusing on what really matters: sustainable, risk-adjusted growth.

A core metric for any multi-protocol allocation strategy is its risk-adjusted return. Think of it this way: earning an 8% yield with very low volatility is way better than chasing a 10% yield that swings wildly and puts your capital in constant jeopardy. The real goal is to measure the efficiency of your returns—how much yield are you actually generating for each unit of risk you're taking on?

This focus on stability is what separates a thoughtful strategy from simple yield chasing. A consistent, lower-risk income stream gives you a much stronger foundation for long-term growth.

Aligning Your Strategy with Your Goals

Before you can measure success, you have to define what it looks like for you. Your personal risk tolerance and financial objectives are the ultimate guide. Are you gunning for aggressive growth, trying to preserve your capital at all costs, or looking for something in between?

Here’s a simple way to think about it:

Aggressive Growth: You’re comfortable with more risk for a shot at higher returns. Your strategy might lean into newer, higher-APY liquidity pools while still keeping a diversified base.

Capital Preservation: Your number one goal is protecting your principal. You’d want a strategy that sticks to established, battle-tested lending protocols known for their security and stable (though lower) yields.

Balanced Approach: You want the best of both worlds—steady growth without taking on crazy risk. This involves blending stable lending positions with carefully selected allocations to moderately higher-yield opportunities.

To really get this right, it can be helpful to borrow ideas from other fields that are obsessed with performance tracking. For instance, looking at how top tech teams master engineering Key Performance Indicators can bring a new level of discipline to your DeFi strategy. This mindset helps you connect your actions directly to the outcomes you want.

The current DeFi market is actually perfect for these kinds of strategies. If you look at the data, the top ten protocols capture around 60% of all fees, forming a concentrated core of reliable venues. At the same time, you have a long tail of newer protocols competing for attention by offering much higher, but riskier, yields. An automated agent can navigate this landscape perfectly, shifting between the safe core and the opportunistic fringe to find the sweet spot. You can get a deeper look at these market dynamics and find more DeFi insights on DL News.

Got Questions? We've Got Answers

Diving into the world of automated DeFi can feel like a big step. That's totally normal. Here are some of the most common questions people ask about multi-protocol allocation to help clear things up and get you started with confidence.

Is This Kind of Strategy Only for DeFi Experts?

Not anymore. While what's happening under the hood is definitely complex, platforms today are built to hide all that complexity from you. The whole point is to make these powerful strategies available to everyone.

You can get the upside of automated diversification and yield-seeking without having to become a full-time degen. No more late nights researching protocols or stressing about risks. The experience is as simple as it gets: deposit your stablecoins, and let the system handle the rest.

How Do You Manage Risk Across So Many Different Protocols?

This is the big one, and managing risk properly is everything. It’s not just one thing; it’s a whole layered approach that starts with rigorous vetting. We only even consider protocols that are battle-tested, with solid security audits, a proven track record, and a reputable team behind them.

From there, it's all about diversification. We don't put all your eggs in one basket. By spreading capital out, any potential issue with a single protocol has a very limited blast radius. On top of that, we have systems running 24/7—both on-chain and off—that are constantly watching for any security threats or weird activity. If anything looks off, automated safeguards are designed to pull funds out immediately.

Think of it like a three-layered defense: strict vetting, smart diversification, and constant monitoring. It's how you can safely navigate the massive opportunities in DeFi without getting wrecked by the complexity. It’s about staying ahead of threats, not just reacting to them.

Can I Get My Money Out Whenever I Want?

Absolutely. Liquidity is a core part of the design. Unlike some strategies that force you to lock up your funds for months or even years, a well-designed multi-protocol system keeps your capital liquid and accessible.

When you decide to withdraw, the system automatically pulls your funds back from all the different protocols they’re deployed in and sends them right back to your wallet. It’s the best of both worlds: your money is actively working for you, but you still have the flexibility and control to access it whenever you need it, no strings attached.

Ready to put your stablecoins to work with an intelligent, automated strategy? With Yield Seeker, you can start earning smarter yield in minutes. Deposit as little as $10 USDC and let a personalized AI Agent handle the rest. Get started at Yield Seeker.